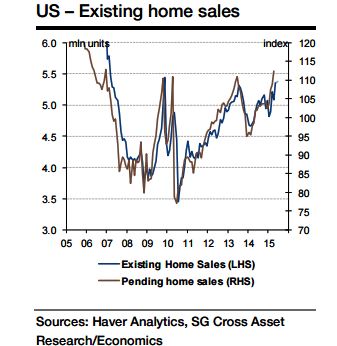

US Housing demand is being underpinned by improved employment and income prospects which have recently triggered a sharp increase in household formations. As of May, existing US home sales stood at their highest level since 2009.

"Resales are also expected to climb further by a modest 0.6% m/m to 5.38 mln units", says Societe Generale.

Admittedly, this has disproportionally benefited the rental market, but there is some evidence that young renters are transitioning into first-time homebuyers.

Although a significant portion of resale activity is still being driven by investors (14%) and all-cash buyers (24%), the ratio of first-time homebuyers has been increasing steadily during the first half of the year and now stands at 32%.

The return of the first-time homebuyers is also evident in the mortgage applictions data, where the volume of purchase applications increased sharply this year.

To be sure, mortgage financing conditions are still tight and continue to be an impediment to housing demand, but at the margin, banks have been easing lending stndards since September 2014.

As access to financing continues to improve, the labor market tightens and rental inflation remains under pressure, further gains are expected to be seen in housing demand.

Existing US home sales to climb further, but slower

Monday, July 20, 2015 3:55 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022