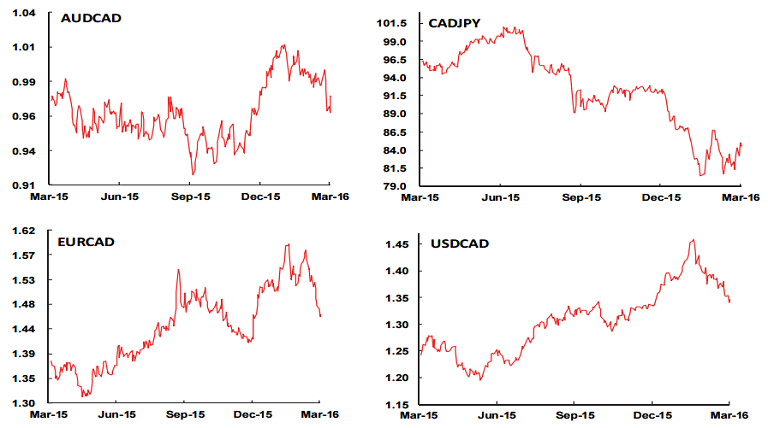

Growth in Canada during 2015 was at its slowest pace since the recession of 2009. Slump in oil prices and China's uncertainty sunk CAD exchange rates (vs USD and GBP) to ten-year lows ahead of the Liberal government's first budget in March 2016. The Loonie tumbled more than 12% against the USD from the middle of October 2015 through the middle of January 2016 in a more or less one-way move.

Brent Crude are currently edging towards US$37 per barrel, buoying sentiment for CAD. The CAD's rebound has been just as spectacular - and relentless. USD/CAD has pared more than two thirds of its losses from Oct 2015 to early 2016 rally in the past six weeks, gaining significant ground on some of the key crosses, rising strongly against the GBP, EUR and AUD for example.

There are a slew of major events lined up this month which could add to CAD volatility. The Bank of Canada is scheduled to meet on 9th to decide monetary policy. FOMC meeting is on the 16th and the Canada's fist Federal budget of 2016 will be unveiled in Ottawa on the 22nd. Expectations are that the central bank would keep its powder dry this month and act, if need be, after the next federal budget when it will be better able to assess fiscal support to the economy.

"The risks around the Fed policy outlook remain significant, however. A rate tightening or hawkish commentary from the Fed could still drive the USD temporarily higher through March. A Canadian budget which delivers significant fiscal stimulus to boost growth (and further reduces scope for BoC rate cuts) should be CAD-supportive", notes Scotiabank in a research report.

An improvement (narrowing) in US-Canada short-term interest rate spreads is also supporting the CAD. Two-year, US-Canada government bond yield differentials peaked at +70bps in mid-January, around the same time that USD/CAD tested 1.47. The spread has subsequently halved, undercutting a key source of support for the USD.

Technicals suggest a significant reversal in the USD bull trend is in the process of unfolding which are USD/CAD-bearish. USD/CAD is extending its downtrend from 1.4690 levels and is trading at 1.3434 at the time of writing (0945 GMT).

"We are more constructive on the CAD's prospects through the middle of the year and think modest USD/CAD rebounds through March/April will be limited to the 1.36/1.38 range. We are retaining, for now, our 1.39 year-end forecast for USD/CAD but risks around the outlook appear to be skewed to the downside", adds Scotiabank.

Expect significant volatility in CAD amidst major event risks this month

Thursday, March 3, 2016 10:02 AM UTC

Editor's Picks

- Market Data

Most Popular