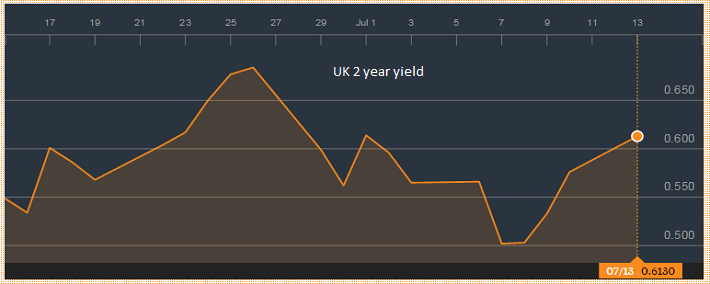

Since last Thursday, when UK budget was done with Gilts have started reversing course.

Market participants were expecting a budget from Chancellor Osborne with much more austerity and lower Gilts issuance. This led to massive buying of UK gilts which saw yields drop more than 30% within a week. Some safe haven flows also might have pushed Gilts higher last week. This massive drop in yield lead to drop in pound against dollar and notably Yen.

However, since Chancellor presented a relatively looser budget and forecasted budget surplus by 2019/20, a year later from originally anticipated, Gilts have reversed course and yields have started rising.

As 2 year yield rose above 0.60% (currently trading at 0.613%), pound also rose from 1.532 to 1.555 against dollar and further rise seem conceivable with focus shifting to monetary policy expectations.

While the world remained focus on Greece and FED rate hike, UK registered significant improvement.

Wages are rising at the fastest pace since 2007 boom. GDP growth is expected to beat even US in second quarter.

However weakness persists in inflationary pressure and manufacturing sector.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?