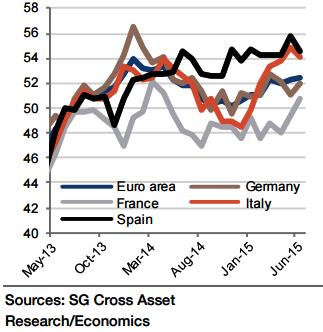

The flash euro area manufacturing PMI, fell more than expected from 52.5 in June to 52.2 in July. This indicates that the manufacturing sector expanded at a slightly lower rate than in June, but still showed strong growth in comparison to the last three years.

The manufacturing sector is taking time to respond to the positives of a weaker euro, structurally lower oil price and easing credit conditions. Looking at the breakdown of the survey, growth in manufacturing output remained robust, whilst new orders growth fell to a three-month low, this suggests potential weakness in the PMI going forward.

However, the PMI remains around the four-year high. Turning to inflationary pressures, the recent trend of tightening profit margins is easing as the output prices component has started to rebound.

"The final manufacturing PMI is likely to inch down from the flash estimate of 52.2 to 52.1. Looking at the breakdown by country, the French manufacturing PMI should confirm the flash estimate of 49.6 in our view, following the sluggish growth in manufacturing confidence seen in the past quarter", says Societe Generale.

The German manufacturing PMI is expected to tick up from the flash estimate to of 51.6. Turning to Italy and Spain, the PMIs are expecetd to remain high but to fall from the June level, consistent with the confidence surveys.

Final Euro July manufacturing PMI set to remain strong

Monday, August 3, 2015 5:05 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022