In France, apart from energy, food and services prices are likely to remain stable while goods prices will remain weak. In July, both French HICP and the national measure slowed by one tick from 0.3% yoy in June to 0.2% yoy. French CPI Ex-Tobacco came in at 126.02 (against our forecast of 126.14).

On the components side, energy prices fell again in July (-4.0% yoy), cutting 10bp from the headline figure. This was led by declining petroleum products, motor fuels, heating fuels and town gas prices. Food prices remained unchanged at 0.4% yoy in July.

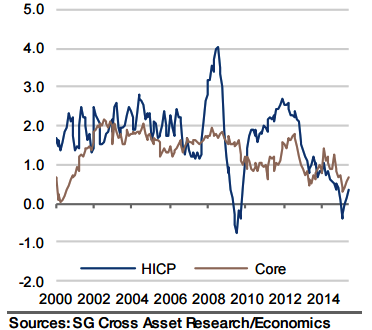

"French HICP inflation is expected to print a tick lower at 0.1% yoy in August compared to 0.2% yoy in July. Similar to the case in other euro area countries, we expect weakness in the energy component on account of continued softening in Brent prices alongside weak gasoline prices to exert downward pressure on the headline figure", says Societe Generale.

For core components, the prices of manufactured products weakened -0.9% yoy in July on account of summer sales with the most noticeable drop in clothing and footwear prices (-1.6% yoy in July). Prices paid for services due to seasonal changes rose noticeably (1.4% yoy in July), led by an increase in prices paid at restaurants, cafes and hotels, airfares, package holidays, and holiday rentals.

"Looking ahead, French HICP inflation is expected to average 0.3% in 2015 and 1.1% in 2016, while the core metric should average 0.7% in 2015 and 1.1% in 2016", added Societe Generale.

French August inflation likely to soften to 0.1% yoy

Monday, September 14, 2015 5:50 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed