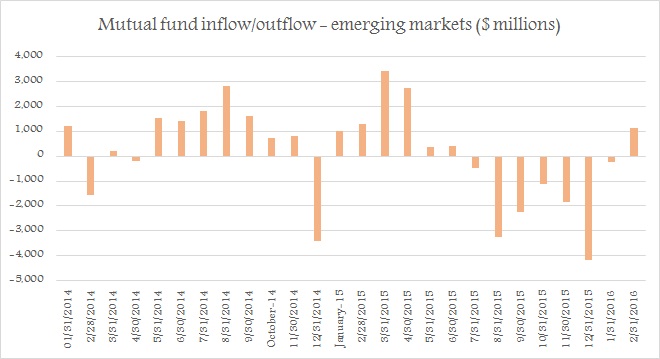

Compared to developed markets, longer term mutual fund size is very much smaller for emerging markets, except for that of China. Nevertheless trend is quite clear from whatever smaller sized data we got in our hands.

2015 hasn't been good for emerging market, more so after China shocker in late summer. August devaluation of Chinese Yuan by people's Bank of China led to global financial market turmoil and record outflow across EM.

- 2015 saw, net outflow from long term emerging market equities in tune of $4 billion.

- However, since August outflow was close to $13 billion.

It is vital to note, that this figure is not a good indicator of total outflow from EM. For example in 2015, China alone suffered somewhere around $ 0.8-1 trillion outflow. Nevertheless it is a good indicator of the trend.

- In 2016, so far, about $900 million has flown into long term mutual funds but January has suffered net outflow, which isn't surprising given financial market turmoil then.

March trend would be important to watch as February is indicating investors returning to EM.