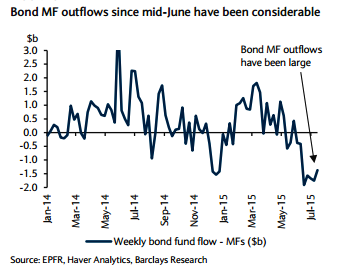

With Fed hikes on the horizon and after the rise in rates, bond MF outflows have been running at nearly a $2bn per week pace since mid-June. Risks of further outflows, weighing on markets are however seen.

After a relatively brief period of equity MF inflows from January 2013 to April 2014, mutual fund outflows have resumed, although at a slower pace. Accordingly, cash levels at equity MFs have been fairly elevated, and betas to benchmarks have been neutral to underweight, in large part because cash is needed to meet redemptions.

Importantly, equity MF outflows abated the week of July 8, likely allowing some funds to put cash back to work. In contrast, bond MFs have had inflows of $1.1trn since 2009; thus, there is a risk that the active-to-passive trend will accelerate in the bond market.

"However, bond MFs are holding more cash, with holdings at nearly 8% of AUM according to ICI. The bond fund beta has also fallen below average, pointing to higher cash", says Barclays.

Further bond MF outflows to weigh on global markets?

Monday, July 20, 2015 6:36 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022