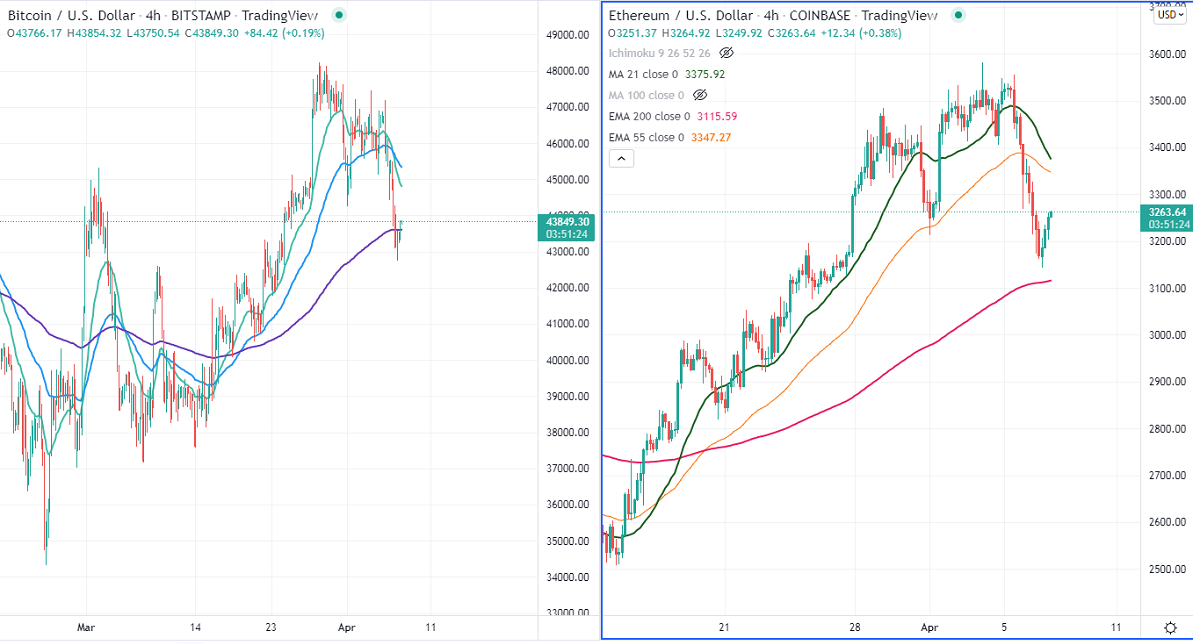

BTCUSD showed a sell-off after Fed meeting minutes. Hawkish Fed comments have increased the chance of an aggressive rate hike by the US central bank. It hits an intraday low of $42714 and is currently trading around $43824.

Bear case-

Levels to watch- $42980 (55- day EMA). Any daily close below that level confirms intraday bearishness. A dip to $42500/$41700/$41000.Significant demand zones are around $37000-$34000. A breach below that level will pull the BTC to $30000/$24900.

Bull case-

Primary supply zone -$44100. The breach above confirms minor trend continuation. A jump to the next level of $46000/$48300 is possible.

Secondary barrier- $48300. Any daily close above targets $50000/$52000.

CCI (50) holds above the zero line in the daily chart.

It is good to buy on dips around $43000 with SL around $41700 for TP of $52000.

Ethereum (ETHUSD)-

ETHUSD regained after a minor decline below the 200-day EMA of $3169.It hits an intraday low of $3143 and is currently trading around $3260.

Bear case-

Levels to watch- $3165. Any violation below will drag the ETH to near-term support of$3000/$2800. Major demand zones are $2700-$2800. A breach below targets $2300/$2150.

Bull case-

Primary - Barrier- $3300. The jump above will mark the beginning of a minor bullish trend. Surge past will push the prices higher to $3500/$3600.

Secondary barrier- $3600. Breach that barrier targets $4000/$4500/$5000.

It is good to buy on dips for $3200 with SL around $3000 for TP of $4000.