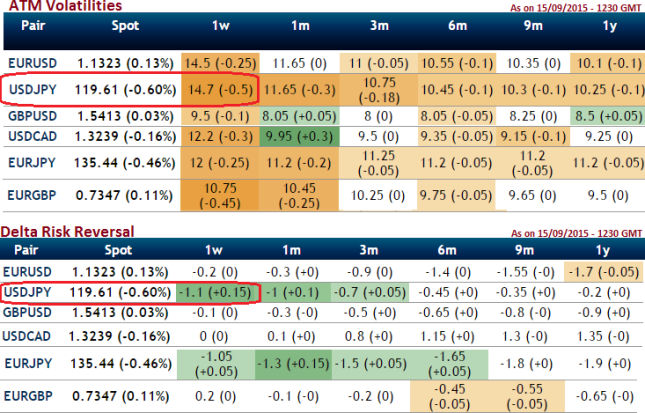

From the above table, we can observe that 1 week contact to perceive higher volatilities on the vege of tomorrow's much awaited fed's meet, delta risk reversal for this pair is also highest negative values among entire G7 currency pool, this would mean that market sentiments for this pair have been bearish for this pair. The pair is likely to perceive higher implied volatility close to 15% of 1W ATM contracts (2nd highest amongst the lot) ahead of fed's meet, thus we recommend deploying short put ladder spreads which would take care of potential slumps on this pair and significantly higher volatility times.

Currency Option Strategy: USD/JPY Short Put Ladder (SPL)

Rationale: unlimited downside and limited upside profit potential

The execution should be in this way: Short 2D (1.5%) ITM put option and simultaneously add longs on 7D ATM -0.49 delta put option and one more 7D (-1%) OTM -0.19 delta put option. The delta of combined position would be at 0.11.

Maximum returns are limited to the extent of initial credit received if the USDJPY rallies above the upper breakeven point (BEP) but large unlimited profit can be achieved should the underlying exchange rate of USDJPY makes a vivid downswings below the lower BEP.

FxWirePro: 1W ATM USD/JPY contracts to perceive highest IV among G7 currency pool – SPL to tackle delta risk reversal

Wednesday, September 16, 2015 6:10 AM UTC

Editor's Picks

- Market Data

Most Popular