The second estimate of UK GDP for 2016 Q2 saw growth unrevised from its previous estimate of 0.6% QoQ, in line with our and consensus expectations. Corresponding annual growth was also unchanged at 2.2% YoY, the strongest since 2013 Q2.

Business investment unexpectedly rose by a seasonally adjusted 0.5% in the second quarter, compared to the consensus forecast for drop of 0.8%. That followed a decline of 0.6% in the preceding quarter.

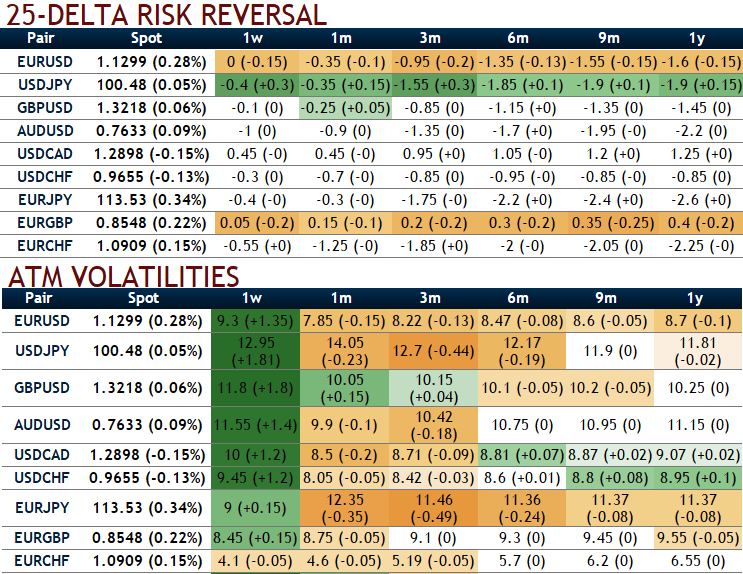

Since the GBPUSD’s implied volatility is perceived to be rising among the major currency counterparts (1W ATM contracts spiking above 11.8%).

While the delta risk reversal indicates hedgers are ready to pay high premiums on OTM puts in longer time horizon.

Cable was sliding towards 1.3213 from the highs of 1.3233 after release of the above economic data, EURGBP was at 0.8538 from 0.8542 earlier and GBPJPY changed hands at 132.17 compared to the prior 132.79.

So relying on this IV and risk reversal indications, one can execute the option strategies as satted follows:

We buy this 1w risk reversals that favours mild bearish sentiments, it is advisable to construct option strips strategy so as to mitigate the risks associated with this pair.

To execute this strategy, go long in 2 lots of 1w ATM -0.49 delta puts and simultaneously, short 1 lot of ATM +0.52 delta calls of similar expiry.

In bottom line, Should the foreign trader reckons that the underlying volatility will likely remain significantly higher in medium term, then this strategy is advisable, he may even wish to hold on to the long term straddle to profit from any large price movement that may occur.

This is exclusively dependant on the revised outlook of the GBP/USD at that time ahead of Fed chairperson Yellen’s speech but for spot FX portfolio would be safeguarded with the least or reduced hedging cost.

However, if the options trader is unsure of what to expect of the underlying, it may be best to take profit (or loss) and move on to evaluate other trading possibilities.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX