The implied volatilities of this GBP crosses are screaming off as we get to see the flurry of economic data this week and during early September, UK PMIs are likely to indicate prospects of their economic health - businesses react quickly to market conditions and Fed is on the focus during mid-June. UK referendum is on the other corner that appends sizeable risks to sterling. Thereafter, manufacturing production and BoE’s monetary policy are likely to add impetus in GBP FX market.

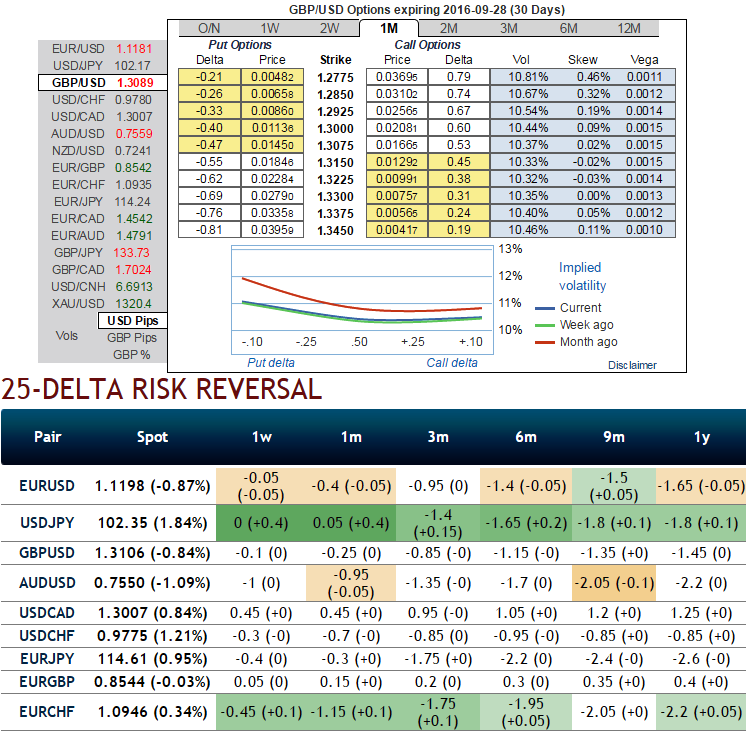

Consequently, 1m IVs of GBP crosses are observed to have spiked massively considering above event risks, highest among G10 currency space.

While the risk reversal numbers are also flashing highest values that indicate the hedging instruments getting expensive in OTC markets anticipating downside risks.

We stated in our previous write up as well that the vols in OTC are likely to pick up rapidly again in 1-3M tenors as these tenors encompass all significant data events.

The above table ranks in rising implied volatility among G10 currency crosses, sterling overreacting due to upcoming economic events but likely to tumble and stabilize at 10.25% in the long run. IV and risk reversal readings of GBPUSD have been the best buys on for selecting an ATM put options.

Hedging bets:

Let's now consider ATM GBPUSD put options of 1m tenors, they are trading at just shy above 10.3%, and you can also be noted that the positive IV skews signal OTM put strikes, which means that OTC sentiments are betting more on underlying FX (GBPUSD spot) to drift below 1.30 levels again.

While delta risk reversals are still flashing up progressively with positive numbers that favour bulls and indicates they are willing to pay OTM strikes in higher vols.

Since IVs of ATM contracts are at higher levels with negative risk reversals would mean that puts have been underpriced relatively to the calls.

At spot FX of GBPUSD is trading at 1.3099, and is anticipated to tumble moderately in the months to come, so it is better to use near-month at the money puts with 50% delta in any hedging strategies. ATM options are far more sensitive since higher IV greatly increases their chances of expiring ITM.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons