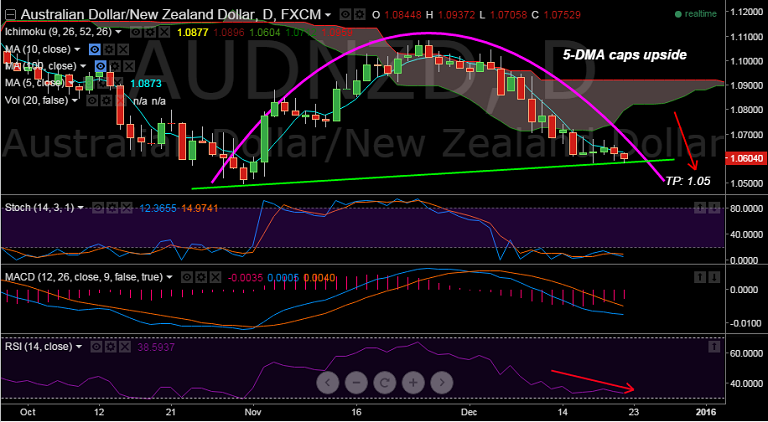

Inverted cup & handle pattern observed on AUD/NZD daily charts, price action is well below the cloud, RSI is at 33 and biased lower.

- Pair tests trendline support at 1.0583, breaks below could target 1.05 levels, watch for AUD/NZD close below 1.0615 for further weakness.

- Consistent lower highs maintains downside pressure, momentum studies are neutral, 5, 10 & 20 DMAs trend south.

Recommendation: Good to sell rallies around 1.0620, SL: 1.0690, TP: 1.05

Resistance Levels:

R1: 1.0628 (5 DMA)

R2: 1.0660 (Session high Dec 21)

R3: 1.0680 (Dec 18 high)

Support Levels:

S1: 1.0583 (Trendline support)

S2: 1.0558 (Oct 29 low)

S3: 1.0572 (Oct 23 low)