- NZD/JPY on track for a second week of losses, as Yen appreciation continues unabated, markets ignore verbal intervention efforts by BoJ authorities.

- Chatter regarding BOJ intervention, in a bid to halt the yen appreciation, has started doing the rounds again.

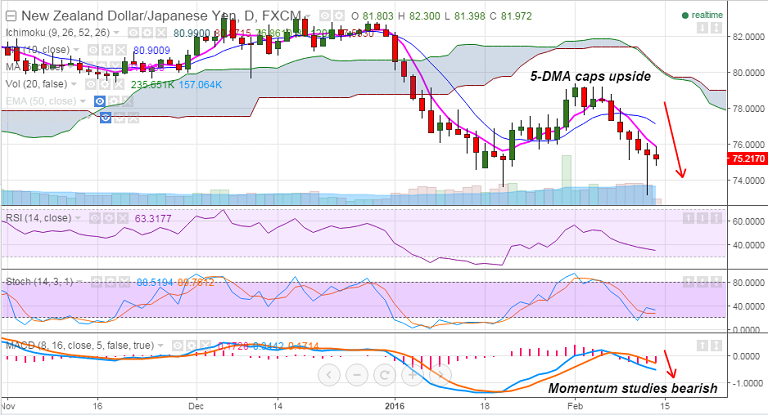

- The pair saw upticks to 75.89, but the pair has edged lower to currently trade at 75.16.

- 5-DMA is strong resistance on the upside, capping gains in the pair, any bullishness can be seen only on breaks above.

- Downside looks vulnerable, momentum is with the bears, RSI and Stochs are biased lower, tests of 73 levels likely.

- Markets continue to track the headlines from Japan and the BOJ for fresh incentives on the Yen.

Resistance Levels:

R1: 75.87 (5-DMA)

R2: 76.0 (Double top - Feb 11th and Jan 18th)

R3: 76.78 (Feb 10th highs)

Support Levels:

S1: 74.45 (Sept 7th lows)

S2: 73.65 (Jan 20th lows)

S3: 73.20 (Feb 11th lows)