The “stable genius” in the White House once again let off a broadside against the Fed’s monetary policy – and in particular against Fed chair Jerome Powell himself. Trump’s verbal attacks only put very temporary pressure on the dollar on the Asian markets this morning. And if one takes a look at the commentaries with other institutions this morning they are dominated by the optimism that the FX market is not going to be intimidated by comments of this nature.

A year on from last year’s catastrophic VIX shock that by all accounts had drawn a line under 2017’s anomalous low volatility regime, February 2019 is ending with G7 FX volatility re-testing cycle lows from 1Q’18. 1M ATM vols across the majors have now fallen well below 6.0 (EUR 1M 5.5, JPY 1M 5.6); even at such low levels, VXY G7 is arguably being held up artificially to some extent by the idiosyncratic Brexit premium in GBP options (GBP 1M 10.1) and perhaps a lingering trace of US/China tensions in AUD (1M 8.3).

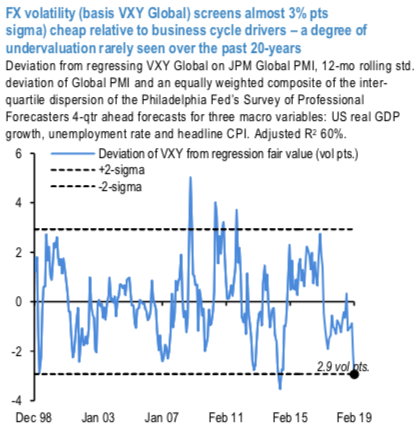

On the whole, FX volatility now screens 3% pts. too low, a hefty 2-std. error deviation from cyclical fair value (refer above chart) last witnessed during the great vol slump of 2Q’14 before mounting expectations of a Fed hiking cycle kicked off the dollar’s multi-year bull run, and before that only once prior to the EM upheaval of the late’90s. That this is not a sustainable equilibrium should be fairly uncontroversial, but tradeable bottoms in FX vol can take 1-2 months to form (Another) deep cyclical undershoot in FX volatility) and our conversations with clients suggest a deep antipathy to paying time decay after this year’s swift post-yen flash crash reversal in vol. March also tends to be a seasonally heavy month for the VXY, perhaps due to the overhang of corporate Yen vega supply in recent years around this time of the year (more on this in the Yen section).

Finally, signs of a bottom in Chinese growth coupled with the odd green shoot in European data lead us to think that placid carry- friendly market conditions can continue for a few weeks more, but the obvious lack of value ought to be a big deterrent against any meaningful G7 vol shorts. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 26 levels (which is mildly bullish), while hourly USD spot index was at 129 (highly bullish) and JPY is at -47 (bearish), while articulating (at 12:45 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts