We apply to precious metals a methodology devised for FX volatilities, Timing FX short-vol strategies, whose objective is that of controlling risk attributed to short-volatility strategies. Short-volatility strategies are often implemented as income-harvesting tools across asset classes, and can bring diversification benefits to multi-asset/strategy portfolios.

However during sharply rising volatility markets, like the one we are currently experiencing, strategies can suffer significant losses. We combine a set of “global” cross-asset indicators with other variables, related to volatility smiles, 25% whose value changes depending on the asset one needs to apply the filter to. While we refer to the previous piece for more details, the simple intuition is that we scale down allocation to short-vol to an asset when either global market risk conditions are declining, or when price action for that particular asset indicates specific risk-aversion.

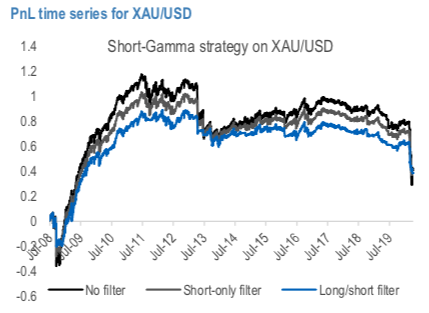

For the trading setup, we monitor 1m 25-delta strangles, trade daily based on the level of the trading filter and held until expiry. The common start date for the analysis is 1 July 2008. We use the following assumptions on the vol bid/ask spreads: for XAU, XAG and XPT 1, 2, 2 vols respectively in a “normal” market and 1.5, 3, 4 vols in a stressed market.

In the following, we will consider a version of the filter (Total-return version of tactical filter allowing long Gamma trades) that allows buying front-dated volatilities when markets are in risk-aversion mode.

At present the tactical model (3rd chart) suggests keeping a neutral-Gamma stance on precious metals, at -3% for XAU and XPT and at -17% on XAG, trimming the long-Gamma exposure from late March. The time series of the average indicator over the three precious metals (refer 4th chart) shows that current signal fell to neutral after reaching significant long-Gamma positioning (+51%) a couple of weeks back, approaching the record high of +57% of late 2008.

We can also see how, unlike during previous risk-off episodes, this time around Gold and Silver have not rallied during a rising vol market, as monetary easing was countered by rising real-yields, given lower inflation expectations. Precious metals rallied from mid-March troughs as market volatilities were falling.

With the strategy allowing to buy Gamma outperforming the benchmark from both a return and Sharpe perspective, for all three assets. The difficulty of implementing systematic vol strategies in precious metals beyond Gold can be noticed, too. This could be due to three factors: a) substantial impact of trading costs; b) large gap moves taking place over short periods of time (as an example, Platinum price dropped by around 40% from mid-February to mid-March); c) generally, a pricing of implied vols which does not discount possible spikes in realized vols, if ever making ownership of Gamma affordable when liquidity conditions permit. Also, when included in multi-asset portfolios, one would need implement risk-management rules that take into account the structurally higher vol of the underlying, something that Vega-scaling alone doesn’t grant.

For XAUUSD (refer 1st chart), the filtering tool managed to cut by 50% the 50% drawdown experienced by the strategy as spot dropped by 12% and short-dated vol quadrupled in just a few weeks, as market bottomed around the 20th of March. The filtering analysis would recommend re-entering short- Gamma trades at the moment, but the intensity of the signal is still very weak. A possible takeaway from the filter analysis would be that of waiting until market conditions / price action stabilize further before considering playing for a tightening of front-dated vol, which remains 14 vol points higher than early February levels.

More interestingly, at only 4pts from the March peak, 3m3m fwd vols downside is more manageable and offering better risk/reward than the 3M-6M spot vols which are already 10-13pts off the recent highs.

Moreover, 2nd chart shows 3m3m FVA returns historically following smooth path during vol normalization episodes making them a low risk exposure.

We recommend: Synthetic short XAU/USD FVA expressed via delta- hedged long 3M vs short 6M straddles gamma neutral calendar @23.8ch vs 23.5/25indic. Courtesy: JPM

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data