A by-product of the dramatic sell-off in USDJPY vol discussed above has been the commensurately sharp compression in cross-yen vs. USD-vol spreads. The observation itself is not new; indeed, one of our current trade recommendations is a long AUDJPY vs short AUDUSD 2Y vega spread, which is predicated on the observation that the 1Y1Y forward vol spread between the two had fallen to zero on account of Uridashi dynamics on dealer books, a highly unusual circumstance for a high-beta yen cross vol to find itself in vis-à-vis a comparatively lower beta USD-vol.

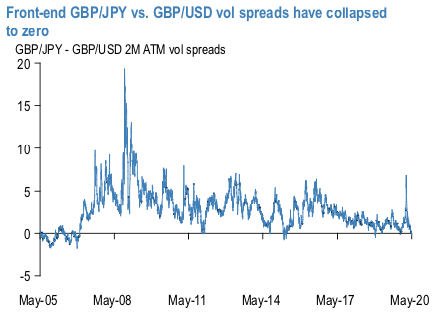

An equally odd set-up is that front end GBPJPY vols have now dropped to flat vis-à-vis GBPUSD vols. There have only been a handful of such occurrences in the post- GFC period, all of which proved to be short lived (refer 1st chart). This is even more surprising in the context of the looming deadline for Brexit talks at the end of June for an extension of the Withdrawal Agreement. Should June negotiations come and go without striking an extension, our macro strategists believe that investors will once again be forced to contemplate a no-deal collapse; indeed, forward- vol pricing continues to tick higher for year-end, indicating a growing sense of concern around the negotiations (refer 2nd chart).

From an empirical performance standpoint, a GBPJPY – GBPUSD vol spread provides convex exposure to Brexit stress.

3rd chart shows that GBPJPY gamma handsomely outstripped GBPUSD gamma over the 2016 Brexit referendum shock – their spread ended up delivering 50% the return of standalone GBPUSD vol around the event, but with orders of magnitude less time decay in the interim. There isn‘t a particularly stark implied vs. realized disconnect in the spread to speak of at present, so we conceptually think of it as a conditional Brexit stress expression – without much/any P/L implication should GBP sail on steadily into and past the June deadline, but likely to kick into a higher should FX markets begin to respond more forcefully to no-deal fear. Obviously, a USD-shock of the kind witnessed in 1Q’20 will be painful for the spread; the hope is that the indiscriminate deleveraging panic of those manic few weeks has been put to bed by the avalanche of Fed liquidity unleashed since then, and that current über depressed implied vol levels can at least partially inoculate the structure against a similar run on risk.

We activate a 2M GBPJPY – GBPUSD straddle spread in the model portfolio; it joins a GBPCHF – USDCHF put switch as a sleeve of carry friendly option trades designed to hedge an otherwise carry-oriented trades portfolio against a revival of Brexit panic. Buy GBPJPY 2M ATM straddle @ 9.1/9.6 vol indic vs Sell GBPUSD 2M ATM straddle @9.0 vol choice indic., equal notionals. Courtesy: JPM

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges