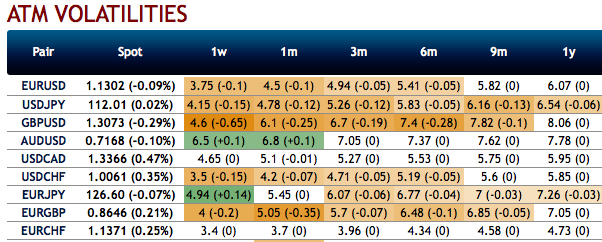

FX volatilities recently, across the board dropped to exceptionally low levels. In such an environment jumps in exchange rates become more likely.

Before we proceed further let’s just quickly glance through above nutshell showing implied volatilities of G10 FX bloc. Majority of the currency crosses are dipping towards the lower side.

As FX options markets enter into Q2’19 with some signs of life in EM where idiosyncratic macro stories have begun to re-emerge (TRY, BRL) and select satellite European currencies (NOK, SEK, HUF) that are proving more responsive to persistent European growth malaise than the Euro itself (refer above chart).

The two pockets that continue to remain stubbornly comatose are G3 and Asia FX. The surfeit of liquidity in the underlying spot in the former has always been the Achilles heel for vol buyers, which perhaps explains why Euro vol ownership has proven to be a frustrating endeavor over the past two decades except for brief periods around the GFC and the European debt crisis.

The other component of the G3 bloc – JPY – has been an enigma for many investors over the past year, and is likely to remain that way in light of the structural shift in Japan’s BoP (outflows) that is muffling the currency's normal anti- cyclicality.

The under-delivery of Asian vols should also not be overly surprising given that yuan stability has been the mantra during the ongoing US/China trade negotiations, with vol dampening spill-overs onto regional currencies strongly anchored by the CNY. Some of these trends will persist into 2Q, others will fade.

If vols start rising from here, there should be winners: the usual safe-haven currencies JPY and CHF. Both already gained this morning, but if I am right and FX vols will permanently abandon the extremely low levels of this week, their current gains should be justified. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 25 levels (which is mildly bullish), hourly USD spot index was at 35 (mildly bullish) while articulating at (12:24 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays