The publication of composite purchasing manager indices for the eurozone has been lackluster (Service PMIs are at 52.5 versus consensus 53.1 and previous flashes at 53.3 levels and Manufacturing PMIs are at 47.8 against consensus 48.1 levels.

European-bloc FX vol can pick up in a variety of ways – if the Euro catches up to the extended stretch of poor data by breaking below 1.10, if Trump turns his attention to tariffs on European autos after a successful China deal, or if the noisy run-up to the European elections in May reignites Italian stress.

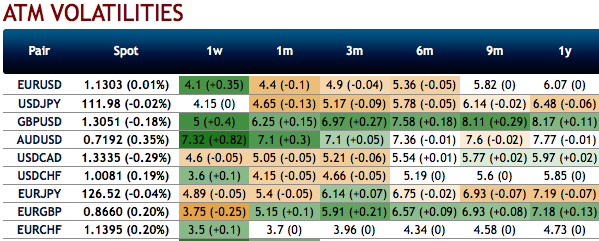

Our FX macro portfolio is well prepared for these unfriendly outcomes via a suite of bearish Euro option structures instituted last week, but sub-6 3M ATM vols in EURUSD are not.

We remain of the view that smaller, less liquid satellite European names like CEE and Scandinavian FX are better ways of playing a spike in Euro vol than EURUSD itself (the currency spread between Euro-bloc vs. EURUSD vols typically widens in stress).

As a complement to directional Euro shorts, owning USDSEK – EURSEK vol spreads can be one carry-efficient way of positioning for this theme. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is showing -51 (which is bearish), while USD is flashing at 135 (which is highly bullish) while articulating at (10:24 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data