Over the longer-term, we expect AU growth to remain subpar and AUD to drift lower. There are a few key things to watch in 2016. Governor Stevens retires in Sept 2016 while a federal election must be held by Jan 2017. AU’s current account deficit is also worth tracking.

We've recapitulated AUDUSD FX information in sequence of the vanilla options market in the volatility smile table which includes Black-Scholes implied volatilities for different maturities and moneyness levels.

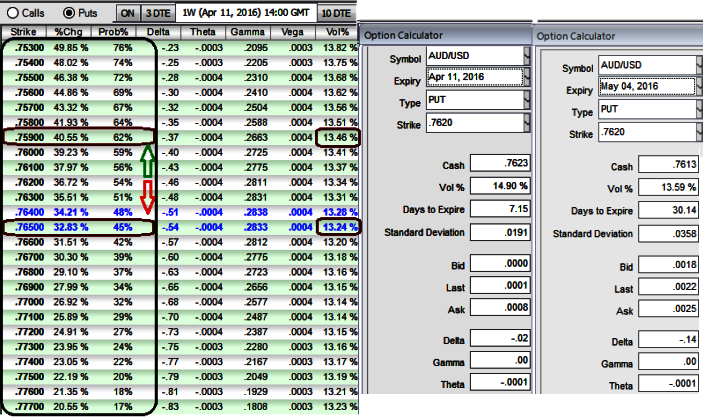

See for the probabilities of different OTM and ITM strikes with their corresponding change in probability numbers as well as option greeks.

For an instance, from spot ref: 0.7620 if it drifts below 30 pips (i.e. 0.7590) and spikes above 30 pips (i.e. 0.7650), we see 62% change in option premiums in OTM strikes case but 45%. Why is this difference even though 30 pips change in underlying price when all parameters remain same?

Now, let's have a glance on something called implied volatility, we consider IVs of 13.46% at 0.7590 and 13.24% at 0.7650 strike price.

The implied volatility as a function of moneyness for a fixed time to maturity is generally referred to as the smile. The volatility smile is the crucial object in pricing and risk management procedures since it is used to price vanilla, as well as exotic option books.

OTM strikes, rely solely on extrinsic value and have a low Delta, Theta, and Vega. But a move towards the OTM territory increases the ATM Vega, Gamma and Delta which boosts premiums.

The degree of moneyness of an option can be corresponded to the strike or any linear or non-linear transformation of the strike. (Forward-moneyness, spot-moneyness, delta).

For an instance, AUDUSD ATM vanilla option has IV at 14.90% for 1w maturities, 13.59% for 1m maturity, but on a strategy or of different strike it certainly varies.

When we choose a slightly out of the money strike put considering delta risk reversal computations, the relative volatility would also change. This is basically because market participants order flows does not expect the direction the strike price that is chosen.

That is because the market participants entering the FX OTC derivative market (heterogeneous) are confronted with the fact that the volatility smile is usually not directly observable in the market. This is in opposite to the equity market, where strike-price or strike-volatility pairs can be observed.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed