Q1’2018 began with an accelerated unfolding of our anticipated baseline themes for 2018 – broad dollar weakness, policy repricing driving strength in non-dollar reserve and European currencies, and synchronized global cyclical strength supporting EM currencies.

But it is ending with a multitude of tail risks threatening to run-over the baseline outlook for 2Q and beyond. Trade tensions worsened significantly with Trump’s Section 301 announcement.

But the process of implementing tariffs on China will take around 45 days, and so we will remain on the uncertain cusp of potential broader trade-war well into 2Q.

This aggressive turn is also likely part of a broader shift in the Trump approach to policy and politics which may similarly translate into greater risks in two key areas: geopolitics and confrontation with the Mueller investigation. Through these headlines and other noise, the assumptions behind the baseline view (eventual ex-US policy normalization, constructive EM growth outlook, late-cycle US dynamics) has generally survived through 1Q.

Leveraged funds turned net buyers of USD for the first time in three weeks as trade tensions escalated and equities were sold. However, real asset managers sold USD amid market volatility.

Leveraged accounts were net buyers of JPY for 11 consecutive weeks, in line with the price action of USDJPY. Funds also bought EUR and GBP (helped by the EU-UK transition agreement reached the previous week).

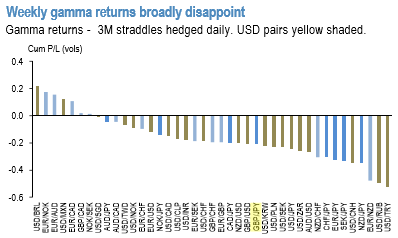

Usually, volatility produces return dispersion among large managers, while FX yields on gamma (refer 1st chart) withstood yet another week of agony as the busy calendar and panic from the US trade actions on the back of the Section 301 investigation report kept implieds supported but failed to revive realized vol (refer 2nd chart).

Moreover, April would consistently be the most FX vol downbeat month (refer above nutshell). That’s in part driven by vol supplying Japanese corporate hedging into the new fiscal year that directly impacts back tenor yen and yen x-vol ultimately spilling over into higher beta currencies.

The risk is that with the trade elephant still in the room, seasonal FX vol trends may be less notable this time around. Since the onset of the trade protectionism theme a few weeks ago and amid potential for a major left tail risk event we have turned defensive.

Our stance has been defensive bias and uphold onto longs cross-JPY vega in spread format (GBPJPY –USDJPY, BRLJPY – USDBRL), long EURUSD and EUR-cross (EURCAD) vol exposure and are short high dollar correlations (NZD vs. JPY) that should mean-revert lower if trade skirmishes intensify. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields