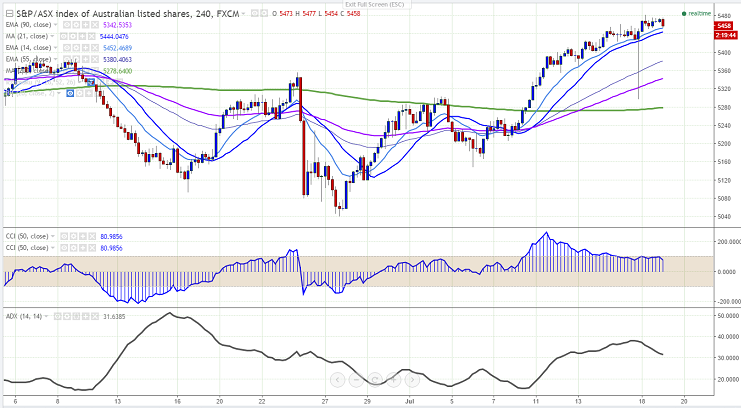

- Major support - 5390 (4 Hour Kijun-Sen)

- The index has retreated slightly after making a high of 5481.It is currently trading around 5457.

- Overall trend is bullish as long as the support 5390 (4H Kijun-Sen) holds.

- Any break above major resistance 5481 will take the index to next level till 5525/5550.

- On the lower side, support is around 5440 (21 4HMA) and any violation below that level will drag the index till 5390/5350/5320 in the short term.

It is good to buy on dips around 5425 with SL around 5365 for the TP of 5500/5550.