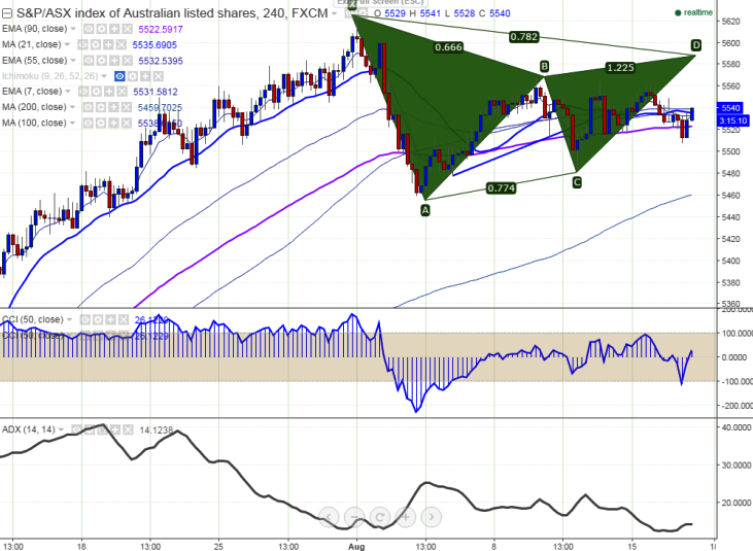

- Pattern formed- Bearish Gartley pattern.

- Potential reversal Zone (PRZ) -5600.

- The index has once again declined after making a high of 5559 yesterday. It is currently trading around 5538.

- On the higher side, major resistance is around 5600 and any break above will take the index to next level at 5625 (Aug 1st high)/5700.

- The minor support is around 5520 (90 4H EMA) and any break below targets 5450 (200 4H MA)/5400 in the short term.

It is good to sell on rallies around 5540-5550 with SL around 5605 for the TP of 5450/5400