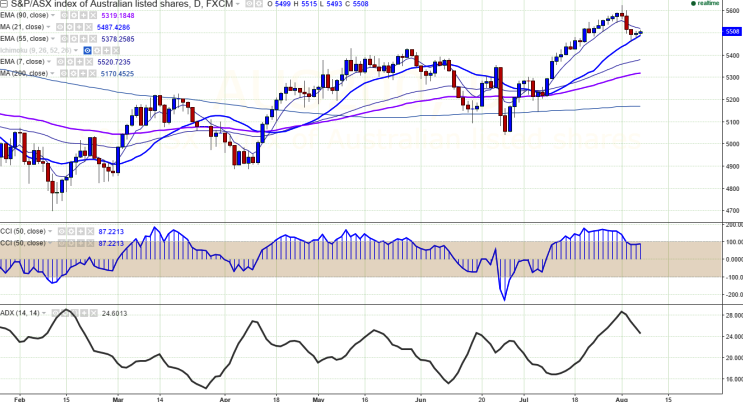

- Major support - 5,473 (21 day MA)

- The index has slightly recovered after making a low of 5476.It is currently trading around 5513.The index is facing strong support at 21 day MA and slight weakness can be seen only below that level.

- Short term trend is slightly bullish as long as the support 5470 (21 day MA) holds.

- Any break above major resistance 5,542 (Daily Tenken-Sen) will take the index to next level till 5600/5625/5,672 (161.8% retracement of 5,431 and 5,041)/5,700 in the short term.

- On the lower side, support is around 5470 and any violation below that level will drag the index till 5400/5440.

It is good to buy on dips around 5500 with SL around 5,460 for the TP of 5555/5600.