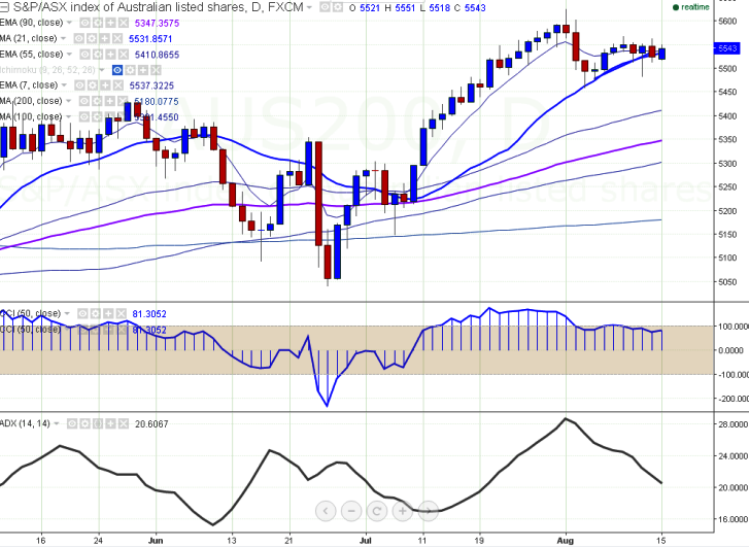

- Major support - 5459 (Aug 3rd 2016 low).

- The index has recovered after making a low of 5483.It is currently trading around 5544.

- The intraday trend is slightly bullish as long as the support 5459 holds.

- Any break above major resistance 5,531 (daily Tenken-Sen) will take the index to next level till 5600/5625/5,672 (161.8% retracement of 5,431 and 5,041)/5,700 in the short term.

- On the lower side, support is around 5460 and any violation below that level will drag the index till 5400/5385.

It is good to buy on dips around 5500 with SL around 5450 for the TP of 5600.