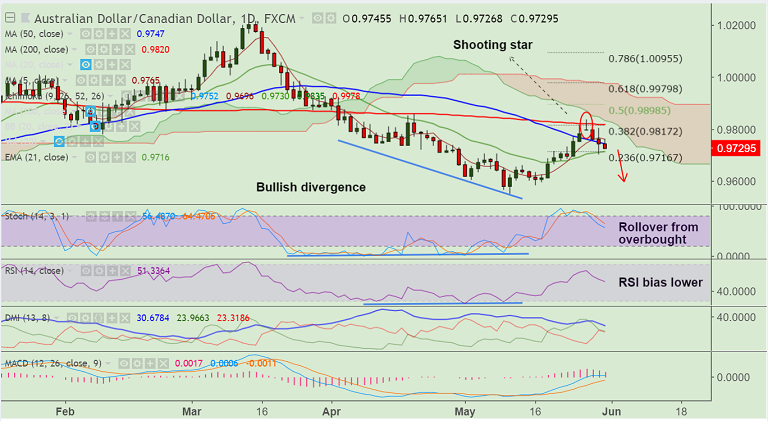

- AUD/CAD struggles at 200-DMA, slips lower from brief break above with a 'Shooting Star' formation.

- The Bank of Canada kept rates unchanged on Wednesday but the hawkish tinge put a bid under the Canadian dollar.

- Soft Aussie Capex figure which has underwhelmed with expected investment coming in below market expectations could add to downside pressure.

- Australia private CAPEX rose 0.4 percent in the first quarter following a 0.2 percent drop registered in the fourth quarter of last year.

- Technical indicators are turning bearish. Stochs have rolled over from oversold levels and RSI has turned south.

- The pair has broken below 50-DMA and eyes strong support at 21-EMA at 0.9716. Further weakness on break below.

- On the flipside, breakout at 200-DMA could see test of 100-DMA at 0.9878 ahead of 50% Fib at 0.9898.

Support levels - 0.9716 (21-EMA), 0.97, 0.9665 (May 21 low)

Resistance levels - 0.9748 (50-DMA), 0.9767 (5-DMA), 0.9820 (200-DMA)

Recommendation: Good to go short below 21-EMA, SL: 0.9750, TP: 0.97/ 0.9665/ 0.9610

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -18.4239 (Neutral), while Hourly CAD Spot Index was at 143.907 (Bullish) at 0500 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.