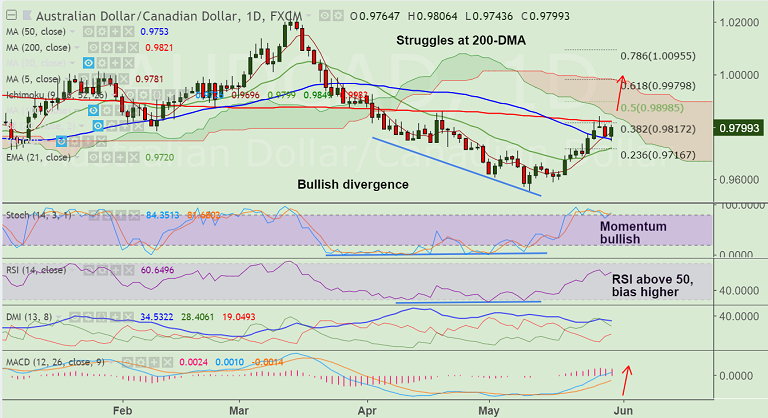

- AUD/CAD struggles at 200-DMA, slips lower from brief break above with a gravestone doji formation.

- The pair is extending choppy trade for the 2nd session, but finds support at 50-DMA at 0.9753.

- Breakout at 200-DMA could propel the pair higher. While break below 50-DMA will see some weakness.

- Next bull target above 200-DMA lies at 100-DMA at 0.9878 ahead of 50% Fib at 0.9898.

- On the flipside, break below 50-DMA at 0.9753 could see drag till 21-EMA at 0.9720.

- Technical indicators are bullish. Focus on BOC monetary policy decision due later today for further direction.

Support levels - 0.9780 (5-DMA), 0.9753 (50-DMA), 0.9720 (21-EMA)

Resistance levels - 0.98, 0.9821 (200-DMA), 0.9858 (100-DMA), 0.9898 (50% Fib)

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at 99.0445 (Bullish), while Hourly CAD Spot Index was at -74.9057 (Neutral) at 1130 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.