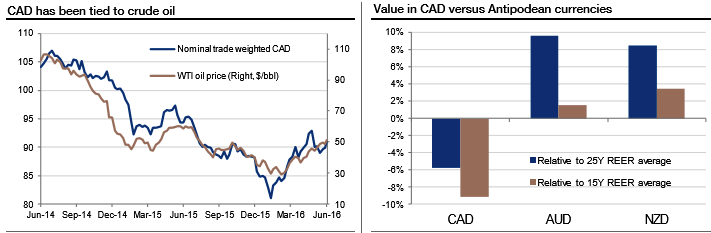

The Canadian dollar’s direction has been heavily influenced by crude oil prices in recent quarters (see above Graph). So long as the recent lows in oil prices hold, there is room for CAD to outperform other commodity currencies in H2 16. It certainly offers better value and is less exposed to China than AUD or NZD (see above Graph).

A Fed rate hike in H2 16 and rising expectations ahead of it are expected to support USD/CAD from monetary divergence. An expected, a plateauing of the oil price trend going forward also eliminates what has been one of the key factors behind CAD strength in the first half of the year. But CAD offers good long-term value, and investors should look to fade any sustained weakness in the coming months.

The Canadian economy is being weighed down by weak investment, a high household debt burden, and the disruption to oil production caused by the Alberta wildfires. The new Federal government’s fiscal stimulus package should help growth, but it is a modest one. The weak exchange rate should continue to drive exports growth, but that is vulnerable to any weakening of US demand. The Bank of Canada is thus likely to stay on hold throughout the year, as it looks to keep CAD weaker.

As a result, we recommend building the hedging portfolio with longs positions in 2 lots of 2m ATM 0.51 delta calls and 1 lot of ATM -0.49 delta puts of 2m expiries.

Delta of far OTM options is very small which is why we’ve chosen ATM instrument on call. A 1 point movement in the underlying pair will not have much effect on the option premium.

Investors need to be optimistic that the volatility in the underlying pair will occur during the short lives of the options. Preferably, the movement will occur towards the leveraged side. If the hoped for price swing does occur, these strategies can be quite rewarding.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand