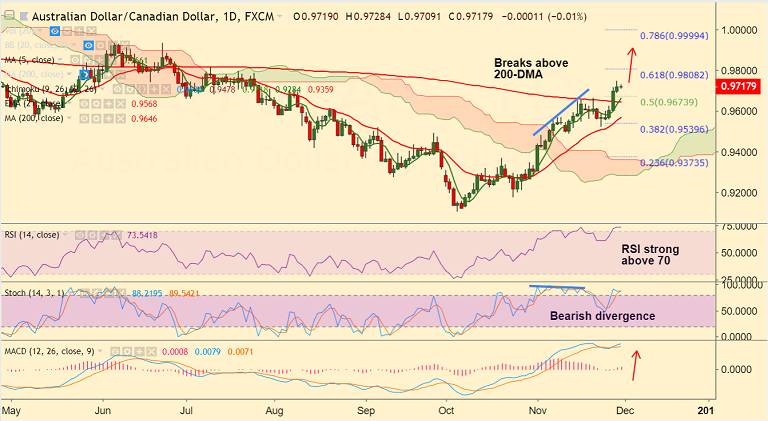

AUD/CAD chart on Trading View used for analysis

- AUD/CAD trades rangebound on the day, markets await Canada GDP data.

- Price action is pausing upside after 5 consecutive sessions of gains.

- Technical indicators support further gains. Stochs and RSI are biased higher, momentum bullish.

- The pair is in a near-term bull trend and breakout at 200-DMA has raised scope for further upside.

- That said, we evidence a bearish divergence on Stochs which dents scope for upside.

- Bias higher as long as 200-DMA support holds. Next major resistance lies at 61.8% Fib at 0.98.

- On the flipside, retrace below 200-DMA could see test of 21-EMA. Violation there to see bullish invalidation.

Support levels - 0.9661 (5-DMA), 0.9646 (200-DMA), 0.9568 (21-EMA)

Resistance levels - 0.9748 (Nov 28 high), 0.9808 (61.8% Fib), 1.00 (78.6% Fib)

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

AUDJPY Smashes 30-Month Peak — Buy the Dip, 112 in Sight

AUDJPY Smashes 30-Month Peak — Buy the Dip, 112 in Sight  EUR/JPY Powers Higher for 2nd Day — Bulls Charge Toward 187+ Breakout

EUR/JPY Powers Higher for 2nd Day — Bulls Charge Toward 187+ Breakout  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  NZDJPY Bulls in Control: Buy-the-Dip Setup Points to 96 Target

NZDJPY Bulls in Control: Buy-the-Dip Setup Points to 96 Target  FxWirePro-Major European Indices

FxWirePro-Major European Indices  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Iran Unrest Sparks Oil Rally — Bounce Off EMA, Buy Dips to $66.40 Glory

Iran Unrest Sparks Oil Rally — Bounce Off EMA, Buy Dips to $66.40 Glory