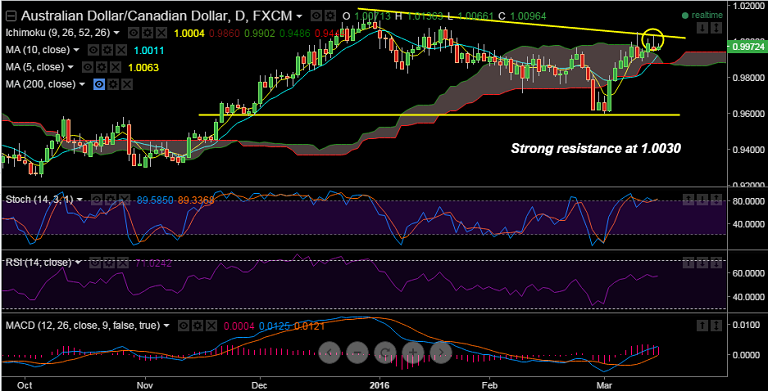

- AUD/CAD was rejected by strong trendline resistance at 1.0035 on Monday and is extending downside to currently trade at 0.9973.

- The pair has strong support at 0.9955 (5-DMA) and breaks below will find next support at 0.9920 (cloud top and 10-DMA).

- On the upside we see strong resistance at 1.0030 (trendline) ahead of 1.0054 (Mar 9th highs).

- Oil is extending downside for a second consecutive day, drop in oil is likely to weigh on CAD and keep AUD/CAD supported.

Recommendation: Go long on breaks above 1.0035, SL: 0.9960, TP: 1.0085/1.0110/1.0170.