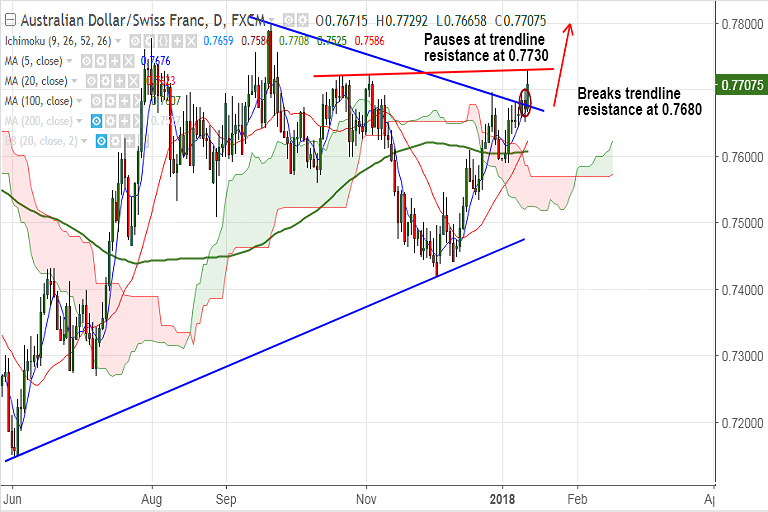

- AUD/CHF has shown a breakout at major trendline resistance at 0.7680, bias higher.

- The pair has hit 15-week highs at 0.7729 before paring some gains to currently trade at 0.77 levels.

- Upside finds minor resistance at 0.7730 (trendline connecting Oct 20 and Nov 2 high).

- Technical indicators support upside, RSI strong at 67 levels with room to run further.

- Stochs are biased higher, ADX is above 25 levels and rising with +ve DMI dominance.

- Next bull target above 0.7730 lies at 0.7755 ahead of 0.78. Retrace below 100-DMA at 0.7607 will invalidate bullish bias.

Support levels - 0.7675 (5-DMA), 0.7622 (20-DMA), 0.7607 (200-DMA)

Resistance levels - 0.7730 (trendline), 0.7755 (Sept 25 high), 0.78 (Sept 21 high)

Recommendation: Good to go long on breakout at 0.7730, SL: 0.7675, TP: 0.7755/ 0.78

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest