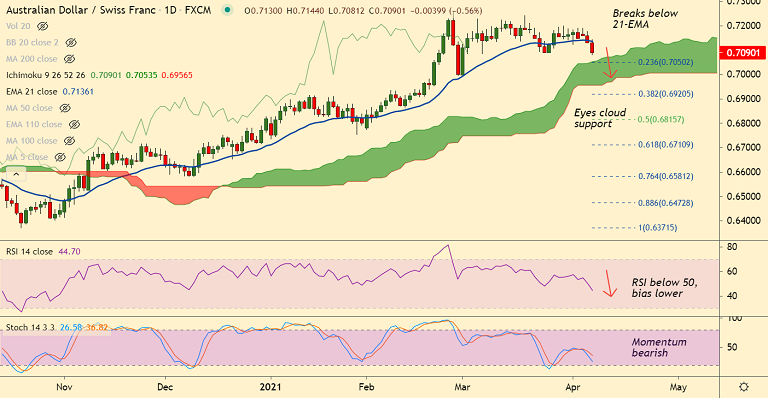

AUD/CHF chart - Trading View

AUD/CHF was trading 0.63% lower on the day at 0.7084 at around 10:00 GMT.

After back-to-back spinning top and Doji formations for the past 3 weeks, the pair is showing signs of weakness.

The pair has paused upside at 76.4% Fib and was trading 0.92% lower on the week till date.

Price action has slipped below 21-EMA which caps upside at 0.7135, 5-DMA is now biased lower.

Stochs and RSI are biased lower and volatility is rising as evidenced by widening Bollinger bands.

Price action has slipped below 200H MA and GMMA shows bearish trend shift on the intraday charts.

Support levels - 0.7062 (50-DMA), 0.7053 (Cloud top), 0.7049 (55-EMA)

Resistance levels - 0.7135 (21-EMA), 0.7155 (20-DMA), 0.72

Summary: AUD/CHF break below 21-EMA has raised scope for further downside. Major trend is bullish, but the pair is on track to test cloud support at 0.7053. Break below cloud will open downside.