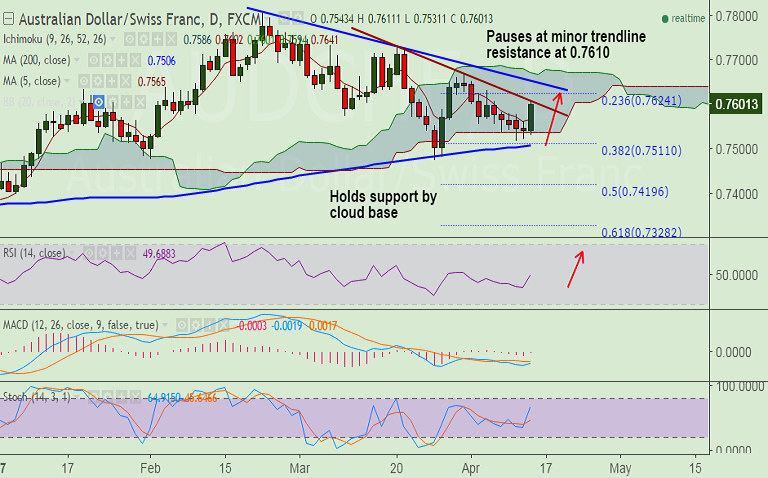

- AUD/CHF has bounced off from near 200-DMA which is major support on the downside.

- Technical indicators have turned bullish after break above 100-DMA at 0.7576.

- Bulls eye next major resistance at 0.7644 (50-DMA). Violation there could see further gains.

- Price action has been ranging between 50 and 200-day moving averages since March 22.

- On weekly time frame, the pair remains capped below weekly 200-SMA currently at 0.7712.

- Breakout above weekly 200-SMA needed for continuation of uptrend.

Support levels - 0.7566 (5-DMA), 0.7538 (cloud base), 0.7506 (200-DMA)

Resistance levels - 0.7610 (trendline), 0.7624 (23.6% Fib retrace of 0.7032 to 0.7807 rally), 0.7644 (50-DMA)

TIME TREND INDEX OB/OS INDEX

1H Bullish Overbought

4H Bullish Neutral

1D Bullish Neutral

1W Neutral Neutral

Recommendation: Good to go long on dips around 0.7580, SL: 0.7550, TP: 0.7625/ 0.7645/ 0.77

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at 101.054(Bullish), while Hourly CHF Spot Index was at -101.521 (Bearish) at 0730 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.