AUD/CHF chart - Trading View

AUD/CHF was trading 0.22% higher on the day at 0.6660 at around 09:40 GMT, outlook remains bearish.

The pair has halted a 6-day bearish streak as oversold conditions seen on the oscillators are resulting in some pullbacks.

Poor China data and risk-off market sentiment are likely to keep upside in the pair limited ahead of crucial RBA policy meet.

A survey by Markit Economics showed on Monday that China's factory activity growth slipped sharply in July as demand contracted for the first time in over a year.

Caixin China Manufacturing PMI for July printed at 50.3, missing expectations at 51.1 and compared to 51.3 in June.

Focus now shifts to the Reserve Bank of Australia’s (RBA) monetary policy meeting due this Tuesday at 0430 GMT, where the central bank is expected to stay pat.

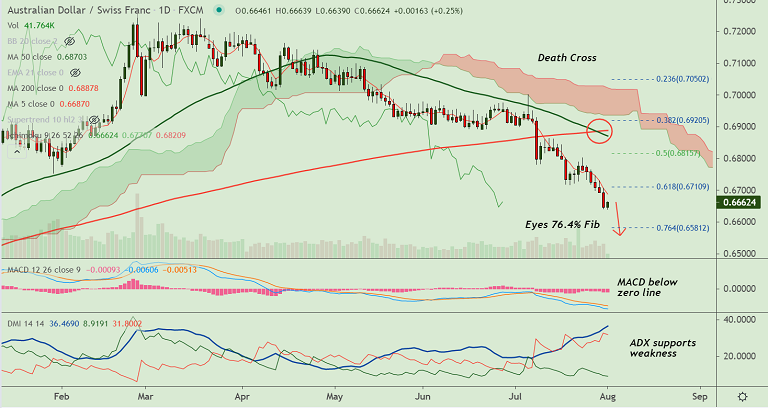

Technical indicators are strongly bearish. GMMA indicator shows major and minor trend are strongly bearish.

Further, a 'Death Cross' on the daily charts keeps limited scope for upside. 5-DMA is immediate resistance at 0.6686. Break above to see gains till 21-EMA at 0.6771.

On the flipside, resumption of weakness will see test of 76.4% Fib at 0.6581 ahead of 88.6% Fib at 0.6472.