- AUD/CHF is consolidating previous session's slump, trades slightly higher on the day at 0.7348 at the time of writing.

- Price action was rejected at daily cloud, and remains below daily cloud and major moving averages.

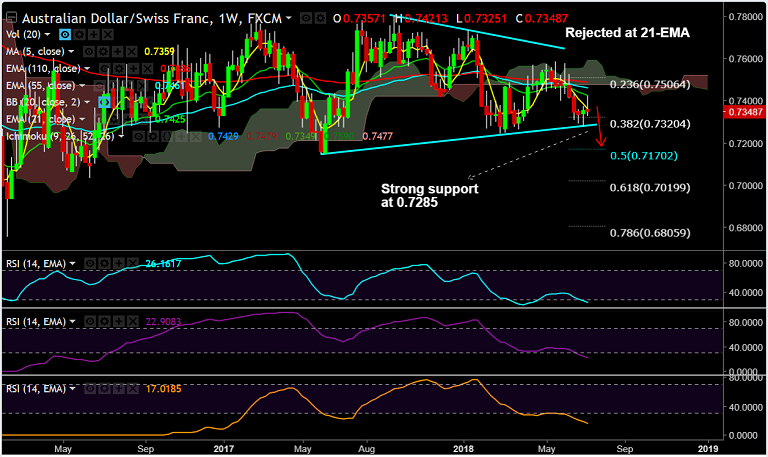

- On the weekly chart recovery was capped at 21-EMA at 0.7425, has slipped below 5W SMA.

- We evidence a 'Shooting Star' pattern formed on the daily charts which supports further weakness in the pair.

- Price action now eyes major trendline support (Triangle Base) at 0.7285. Breach at 'Triangle Base' raises scope then for test of 0.7242 (2018 lows).

- MACD and ADX in support of further weakness. Stochs show rollover from oversold levels and RSI shows weakness.

- Bearish invalidation only on break above cloud base.

Support levels - 0.73, 0.7285 (trendline), 0.7263 (Mar 28 low), 0.7242 (2018 lows till date)

Resistance levels - 0.7368 (converged 21-EMA & 5-DMA), 0.74, 0.7487 (cloud top)

Recommendation: Good to stay short on upticks around 0.7255/60, SL: 0.74, TP: 0.73/ 0.7280/ 0.7245.

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -21.1943 (Neutral), while Hourly CHF Spot Index was at 42.5205 (Neutral) at 0500 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.