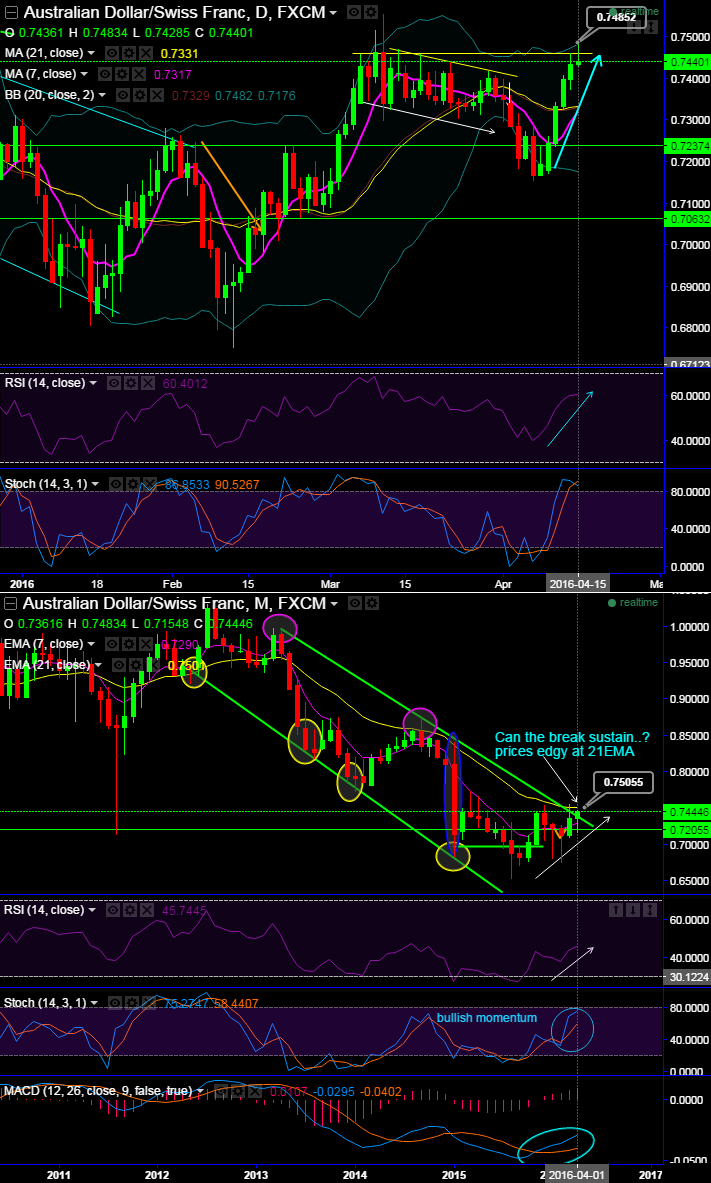

From last 6 days attempts of bounces has now been struggling at 0.7582 levels (Upper BB), it has bounced from 0.7168 to 0.7583 levels (today's high).

We now emphasize "0.75 (or 0.7482)" areas as stiff resistance (21EMA) of sloping channel as shown on the monthly graph. Now at peaks, a most likely gravestone doji occurrence signifies weakness again.

However, daily RSI is still converging upwards to the current price rallies.

MACD is also substantiating weakness as indicates sell on daily.

Monthly watch:

Downtrend sliding in sloping channel, every now and then attempts of bounces were suppressed at channel resistance and EMA curves.

Most importantly, we advise not to get deceived by the indications generated from RSI, stochastic and MACD oscillators as you can probably guess what would happen as and when the pair approached channel resistance in past and these technical indicators stand vulnerable with bearish pressures.

Hence, contemplating the previous long term downtrend, we think this pair had taken a brief pause in last several weeks while a slight recovery took place. But for intraday speculative purpose, one can think one touch binary puts for target of 30-40 pips.