We begin with the reference of put options, hereinafter when we refer OTM or ATM strikes it is deemed as put options with OTM strike prices.

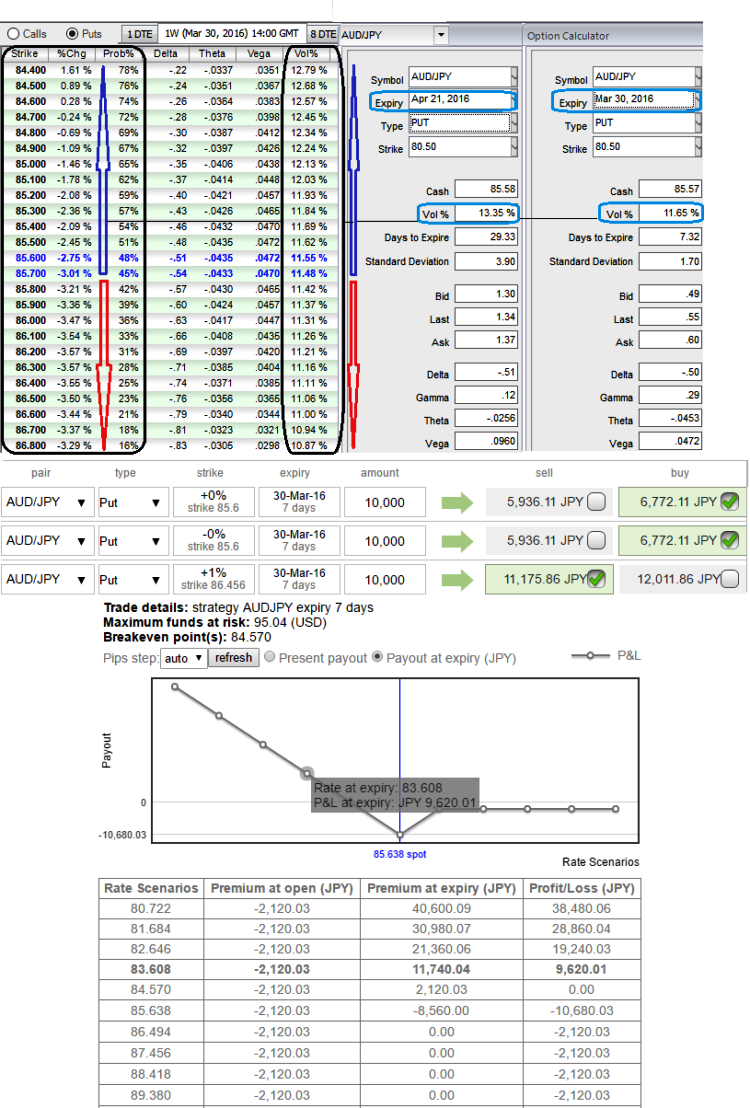

Well, the implied volatility of ATM contracts are spiking from 11.65% in 1w expiries to 13.35% in 1m expiries.

This has been in sync with OTM strikes and justified by historical volatilities (refer sensitivity table for different scenarios of option strikes, glance 6 levels above for vega 0.0438 at higher volatility of 12.13% and 6 levels below for vega 0.0420 at reduced vols at 11.21%).

This pair has been oscillating between 86 and 84 range.

Technically, buying momentum is reduced as it approaches upper bracket (86) but long term downtrend seems to be intact on convincing volumes along with massive dips and technical indicators favouring bears on monthly charts.

As we expect the underlying currency exchange rate of AUDJPY to make a larger move on the downside. As shown in the figure purchase 1M 2 lots of At-The-Money -0.52 delta puts and sell 1W one lot of (1%) In-The-Money put option with theta either closer to zero or positive .

Please be noted with extreme cautiousness that the probabilities of ATM puts expiring in the money are very higher but lower in case of higher striking put options (refer highlighted area for probability column).

So far we all know that the position uses long and short puts in the ratio, such as 2:1 or 3:2 and so on to maximize returns depending upon risk appetite and returns expectations.

Based on volatility and time decay, the strategy is a "price neutral" approach to options, and one that makes a lot of sense.

When it comes to payoff significance what if the strategy works out as per your analysis and what if doesn't, the above chart and table evidences the strategy's present or at expiration payout over a range of rate scenarios,

The delta ATM puts are likely to fetch exponential yields as the spot FX reaches 84 range or drifts even lower.