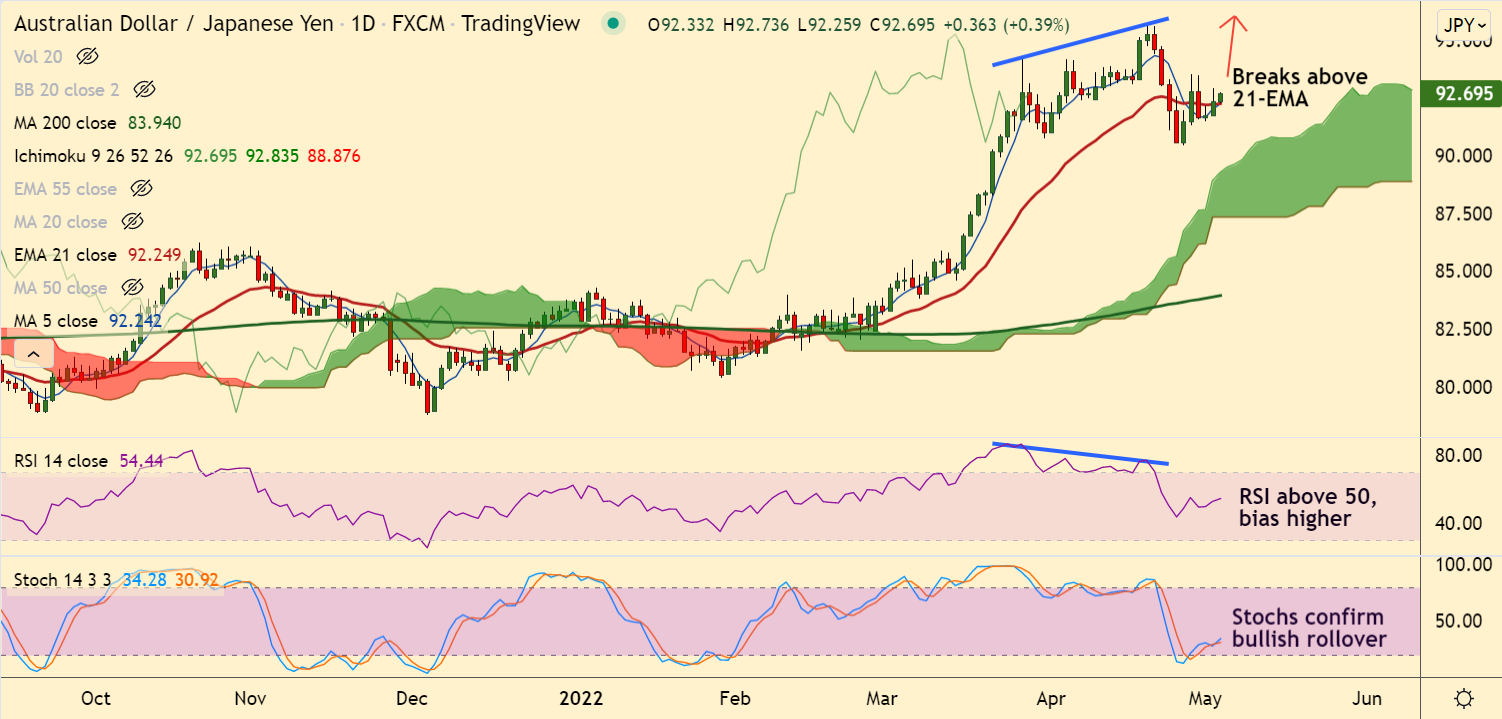

Chart - Courtesy Trading View

Technical Analysis: Bullish

AUD/JPY was trading 0.40% higher on the day at 92.71 at around 12:00 GMT. The pair has broken above 21-EMA raising scope for further upside.

Risk-negative headlines from China and Russia, mainly linked to the coronavirus resurgence support the yen and keep upside capped.

That said, the Reserve Bank of Australia’s (RBA) hawkish bias and readiness for more such moves supports the pair higher.

The RBA superseded market expectations of a 0.15% rate hike with 25 basis points (bps) of a lift to the benchmark rate.

On the data front, Australia’s Retail Sales for March rose past 0.6% market consensus to 1.6%, versus 1.8% prior.

Further, Australia’s S&P Global Services and Composite PMIs eased below the previous readouts of 56.2 and 56.6 to 55.9 and 56.1 respectively.

Retrace in the pair on account of Bearish RSI divergence has retraced above 21-EMA. Immediate resistance lies at 20-DMA at 92.92.

Break above 20-DMA will see further gains. Failure to hold above 21-EMA negates any further bullishness.