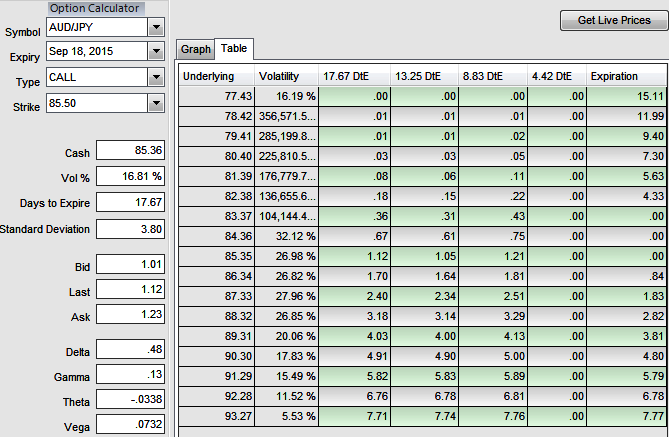

As you can see implied volatility of near month ATM calls are perceived almost close to 16.85% which is at quite higher side while using vega spreads we can neutralize IV effects and participate in prevailing short term downswings.

AUD/JPY Put Ratio Back Spread:

One can build AUDJPY put ratio back spread regardless of swings by improving odds in its positions as explained below. That In-The-Money puts on short side in put ratio back-spreads are always at risk of exercise if the market tumbles, but you have two advantages.

Firstly, keeping maximum tenor on long side: Giving a longer time to expiration for long sides, any abrupt drastic moves on the downside so that assignment can be covered by the long puts.

Secondly, time decay advantage: Using near month contracts or contracts shorter tenor on short side signifies the importance of entering the position when IV is lower than average but AUDJPY IV is seen at 10% which is quite higher side (due to data season), so let us keep maturity on short side as normal as near month contract period. Time decay and implied volatility work in your favor on the short puts.

FxWirePro: AUD/JPY PRBS hedging perspectives on higher IV

Tuesday, September 1, 2015 9:10 AM UTC

Editor's Picks

- Market Data

Most Popular