- AUD/JPY fails shy of 50-DMA, extends downside for 2nd consecutive session.

- Price action has slipped below 5-DMA and Technical studies have turned slightly bearish.

- Stoch is on the verge of a rollover from overbought levels and RSI has turned south.

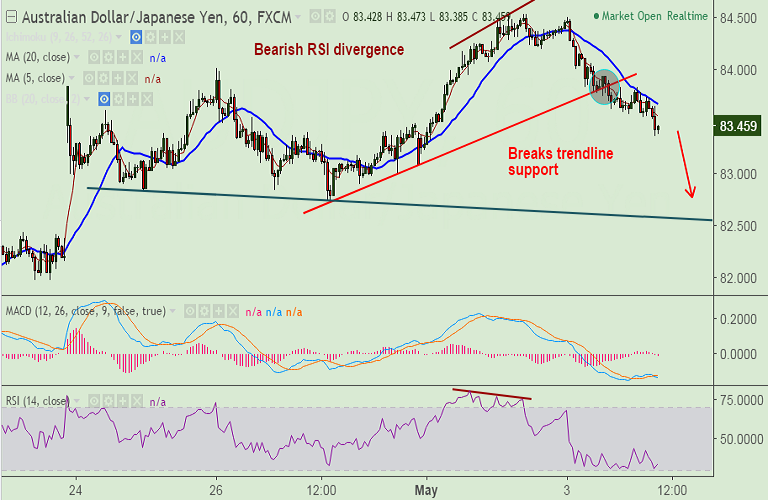

- On hourly charts, we have seen a bearish RSI divergence and break below trendline support at 83.85.

Support levels: 83.06 (23.6% Fib of 88.176 to 81.486 fall), 82.73 (Apr 24 low), 82.31 (200-DMA)

Resistance levels: 84.04 (38.2% fib), 84.54 (May 2 high), 84.63 (50-DMA).

TIME TREND INDEX OB/OS INDEX

1H Bearish Near oversold

4H Bearish Neutral

1D Neutral Neutral

1W Neutral Neutral

Recommendation: Good to go short on rallies around 83.55, SL: 84.10, TP: 83/ 82.75/ 82.30

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -87.2878 (Neutral), while Hourly JPY Spot Index was at -25.5159 (Neutral) at 0730 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.