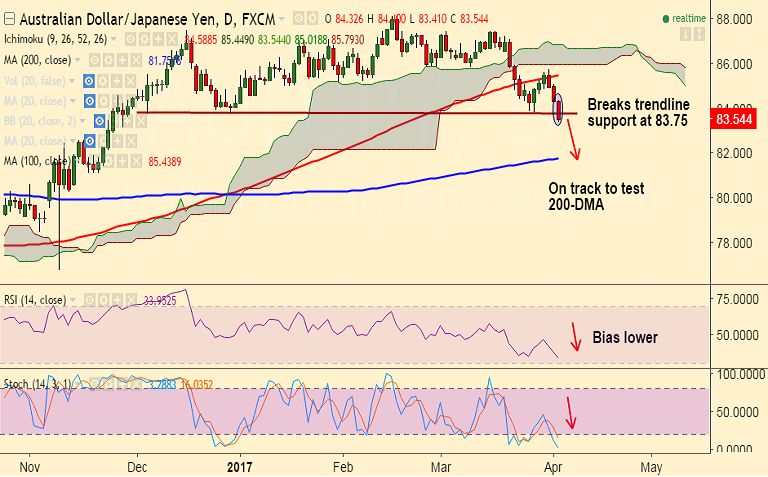

- AUD/JPY extending declines after failing at 100-DMA on March 31st trade.

- Break below major trendline at 83.75 has opened scope for test of 200-DMA at 81.75.

- Weekly charts highly bearish, RSI and Stochs steeply inclined lower.

- Next immediate support is seen 83.16 (Nov 28 low), and immediate resistance is seen at 84.69 (5-DMA).

- RSI on daily charts is nicely converging with price action.

Support levels - 83.16 (Nov 28 low), 82.16 (38.2% Fib retrace of 72.43 to 88.17 rally), 81.75 (200-DMA)

Resistance levels - 84.46 (23.6% Fib) 84.69 (5-DMA), 85, 85.43 (100-DMA)

Recommendation: Good to go short on rallies, SL: 84.50, TP: 83.15/ 82.50/ 82.15/ 81.75

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -143.735(Bearish), while Hourly JPY Spot Index was at 105.025 (Bullish) at 1040 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.