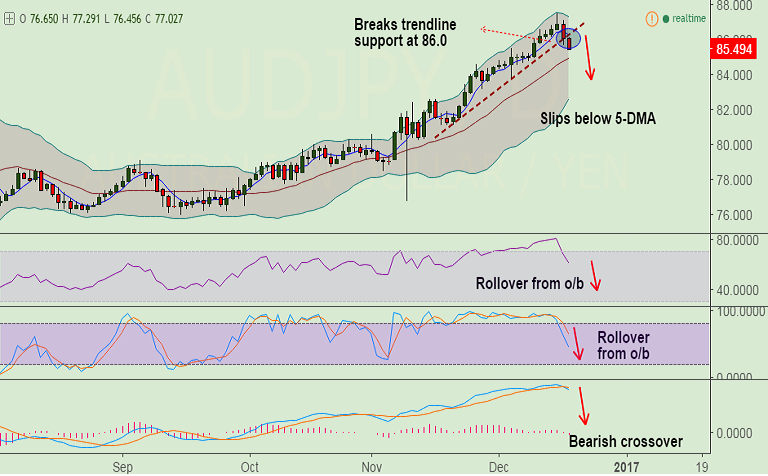

- AUD/JPY breaks major trendline support at 86, remains capped below 5-DMA.

- Technical studies have turned bearish. We see scope for test of 20-DMA at 84.93. Violation there could see drag upto 81 levels.

- RSI and Stochs have rolled over from overbought zone and MACD has shown a bearish crossover.

- Support levels - 84.93 (20-DMA), 84, 83.76 (Dec 5 low), 83.16 (Nov 28 low)

- Resistance levels - 86, 86.31 (5-DMA), 87, 87.14 (Dec 16 high), 87.53 (Dec 15 high)

Recommendation: Good to go short on rallies around 85.75, SL: 86.40, TP: 85/ 84/ 83.75

FxWirePro's Hourly AUD Spot Index was at -117.77 (Highly Bearish), while Hourly JPY Spot Index was at -77.4329 (Bearish) at 0630 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.