For the upcoming days, Japanese politics to take a center stage, the main focus for JPY will be a snap election which will be held on Oct. 22.

Bearish scenarios:

1) The unemployment rate moves back towards 6%, forcing the RBA to respond more aggressively to weak inflation

2) China data weaken materially.

Bullish scenarios:

1) China eases policy and commodities rebound

2) The RBA adopts a more hawkish tone to its communications. Yesterday, the RBA minutes are released and will provide the Board’s opinion on the key topics of housing, jobs, and the consumer.

So far, RBA outlook seems to be on hold for some time which is anchoring short-maturity interest rates and should keep 3yr swap rates in a 1.8% to 2.3% range, as long as core inflation remains below 2%.

While JP Morgan’s projections of AUDJPY at 81 by Dec’2017, 79 by Q1’2018.

Hedging framework (AUDJPY):

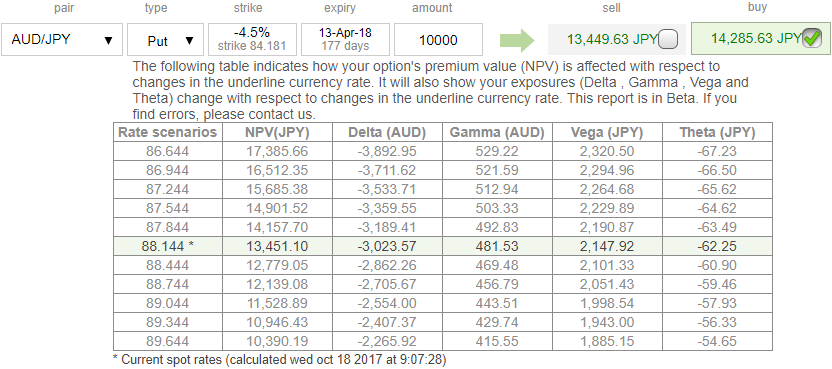

On hedging grounds, risk-averse traders, capitalizing ongoing rallies of the underlying spot FX, we advocate snapping rallies and buying a 6M 84.250 AUDJPY one-touch put. This position likely to fetch exponential yields in payoff structure as the underlying spot FX keeps dipping (refer nutshell evidencing payoff structure).

Please be noted that the 6m ATM IVs of this pair is trading at 9.39%. While OTM put is priced at 6.2% of NPV which is in sync with IVs of this tenor and reasonable contemplating above bearish risk factors.

Those who wish to reduce the cost of hedging; we advocate buying 4M sell 2M AUDJPY put spreads at 86/90.159 strike in 1:0.753 notionals.

Vols of 2m tenors are at the lower side which is conducive for option writers, hence, we’ve chosen ITM striking put as we agree with JP Morgan’s projections.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 89 levels (highly bullish), while hourly JPY spot index was at shy above -15 (mildly bullish) while articulating at 03:48 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data