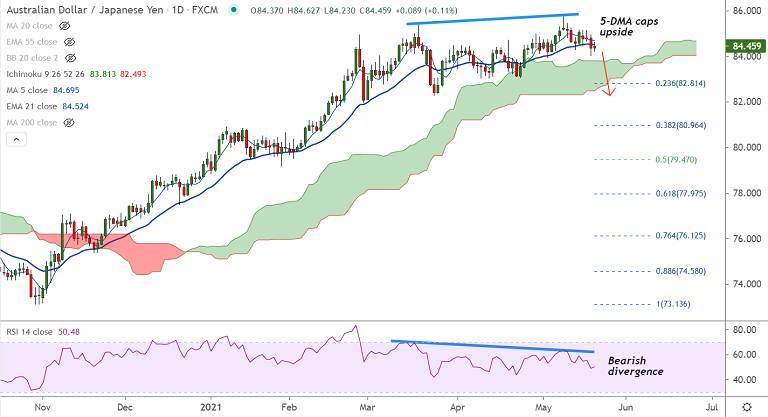

AUD/JPY chart - Trading View

AUD/JPY was trading largely unchanged at 84.39 at around 10:25 GMT, after closing 0.53% lower in the previous session.

The pair is extending pullback from multi-year highs at 85.80, 'Bearish Divergence' on RSI on the daily charts adds downside pressure.

On the data front, Australia’s headline Employment Change missed forecasts with -30.6K versus +15K forecast and 70.7K prior.

However, the Unemployment rate printed at 5.5% level better than expectations at 5.6% and similar previous readouts.

Further, Australia Consumer Inflation Expectations for May eased below 3.6% market consensus to 3.5%, versus 3.2% prior.

Also, the People’s Bank of China (PBOC) matched the wide market forecast and kept its benchmark rate at 3.85%. The five-year LPR was also left unchanged at 4.65% in May.

AUD/JPY closed the previous week with a Doji formation suggesting traders' hesitation to take prices higher.

Further oscillators on the weekly charts are at overbought levels and on verge of rollback into neutral territory.

Price action has slipped below 21-EMA, upside is capped at 5-DMA with scope for test of 55-EMA support.

Daily cloud offers strong support, breach below will open downside for the pair. Next major support lies at 38.2% Fib at 80.96.