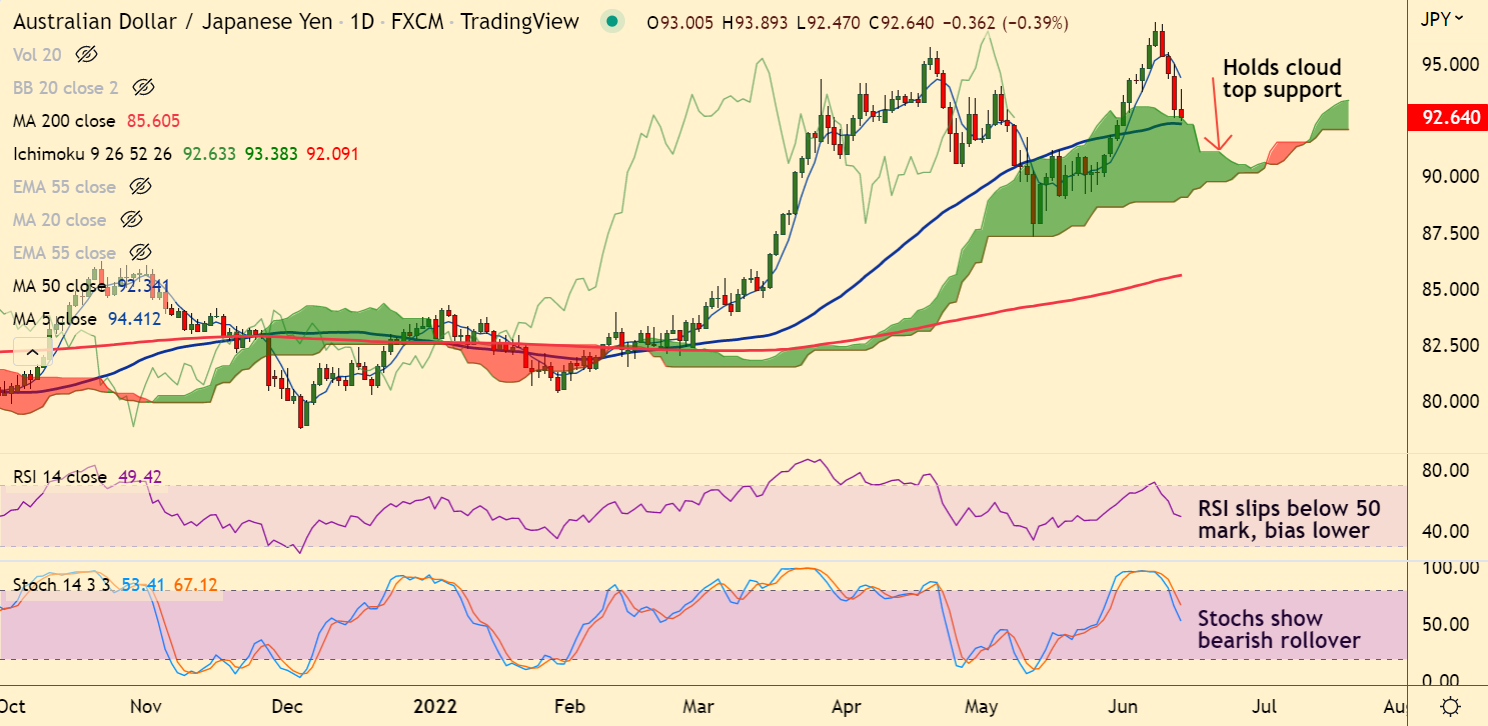

Chart - Courtesy Trading View

AUD/JPY was trading 0.43% lower on the day at 92.61 at around 10:45 GMT. The pair has erased early gains and has edged lower from session highs at 93.89.

Softer Aussie data and deteriorating market sentiment keep downside pressure on the pair.

The National Australia Bank’s (NAB) Business Conditions and Business Confidence gauges eased to 16 in May, suggesting pessimism surrounding the Aussie markets.

The Business Confidence gauge slipped to 6 during the said month from a prior month reading of 10.

Technical indicators are bearish. Price action has slipped below 21-EMA and is holding support at 20-DMA and daily cloud.

Momentum is bearish. Volatility is high. Break below 20-DMA and cloud top will drag the pair lower.

Support levels - 92.34 (50-DMA), 91.51 (55-EMA)

Resistance levels - 93.04 (21-EMA), 94.42 (5-DMA)

Summary: AUD/JPY trades with a bearish bias. Watch out for break below daily cloud top for more weakness.