Chart - Courtesy Trading View

AUD/JPY was trading 0.10% higher on the day at 93.39 at around 11:00 GMT.

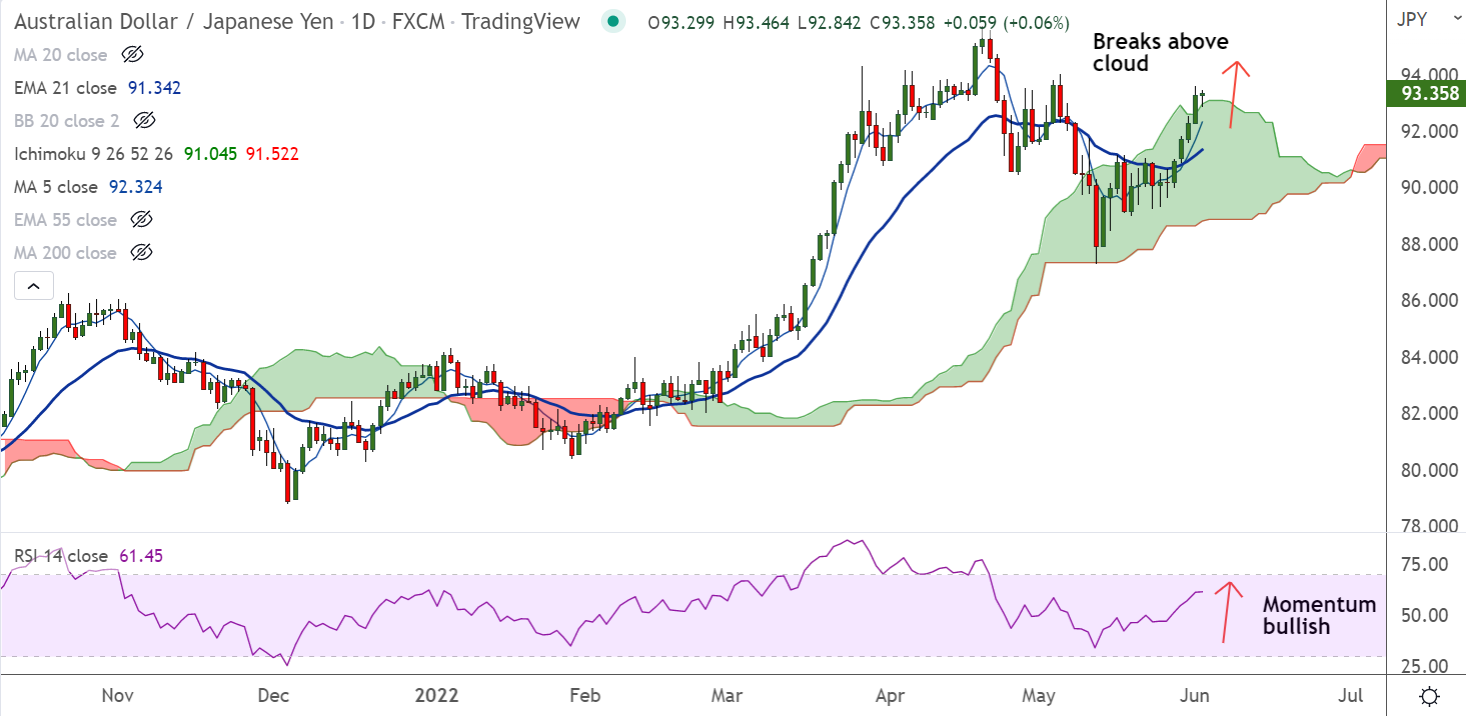

The pair has edged higher from session lows at 92.84, finds strong support at daily cloud.

Growing fears of global recession and the hawkish central bank chatters to weigh on market sentiment, initially dragging the pair lower.

That said, upbeat Australia trade balance data limits downside. Australia’s Trade Balance rose to 10,495M beating 9,300M market forecasts and 9,314M prior.

Further details of the report showed the Exports grew to 1% versus 0% previous readings while the Imports eased from -5.0% to -1.0%.

AUD/JPY trades with a bullish technical bias. GMMA indicator shows major and minor trend are bullish.

Support levels - 92.96 (Cloud top), 92.34 (5-DMA), 91.92 (50-DMA)

Resistance levels - 94.02 (May 5th high), 95, 95.74 (April 24 high)

Summary: AUD/JPY was trading with a bullish bias. Momentum is with the bulls. Break above cloud has raised scope for further upside.