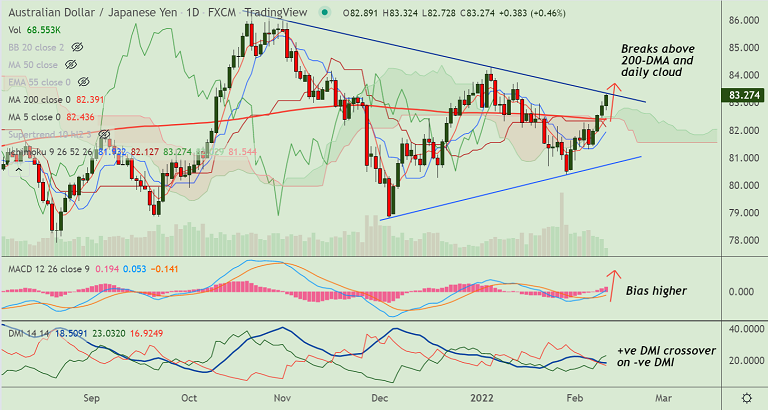

Chart - Courtesy Trading View

AUD/JPY was trading 0.47% higher on the day at 83.27 at around 10:15 GMT, outlook is bullish.

The pair is extending break above 200-DMA and daily cloud, technical indicators support further gains.

MACD confirms bullish crossover on signal line, price action is above 200H MA.

Volatility is high and momentum is bullish. GMMA indicator shows minor trend has turned bullish on the daily charts.

The Australian dollar buoyed on expectations of a hawkish stance from the RBA.

Markets have moved to price in more moves by the RBA, with the first move to 0.25% is implied by June. Further increases to 2.5% are priced in by July 2023.

Sino-American tussles escalate, keeping markets risk-off. Also fears of Russia’s invasion of Ukraine also test optimism and could limit gains.

Price action is extending trade in a Symmetric Triangle pattern. Breakout above will propel the pair higher.