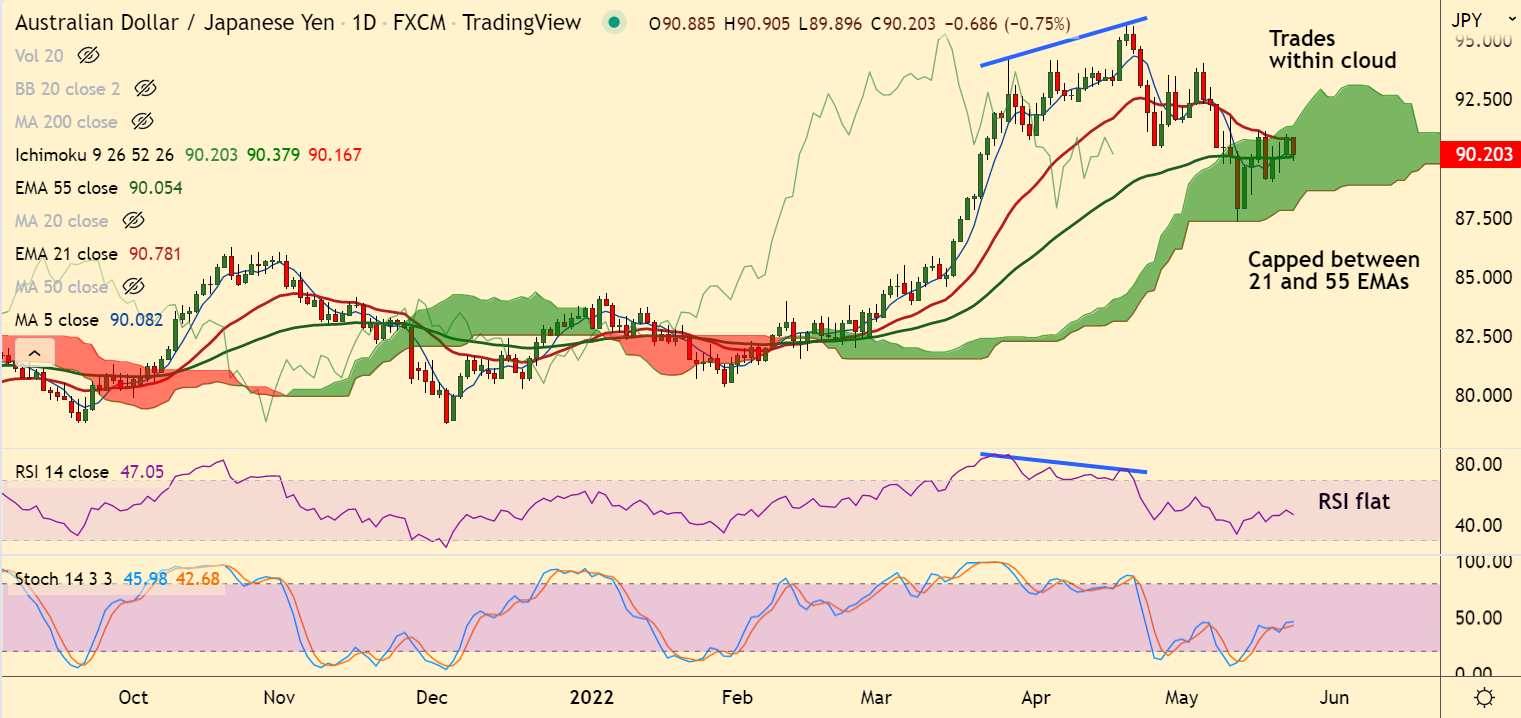

Chart - Courtesy Trading View

AUD/JPY was trading 0.70% lower on the day at 90.25 at around 11:30 GMT, bias remains neutral.

Australian dollar dampened after mixed PMI data. Australia’s S&P Global Manufacturing PMI for May came in softer at 55.3, versus 57.8 expected and 58.8 prior.

Services PMIs, on the other side, rose past market consensus to 53.0, compared to 56.6 prior (revised) and 52.2 forecast. Composite PMI also eased to 52.5 from 55.9 prior.

Japanese Finance Minister Shunichi Suzuki said in a statement on Tuesday, “we will take serious action in response to pricing increases.”

BOJ’s Nakamura was on the wires earlier on Monday, said "the BOJ will continue to ease monetary policy to assist the economy.”

AUD/JPY trades within the daily cloud. Price action remains capped between 21 and 55 EMAs.

Technical indicators do not provide a clear direction, breakout will decide further course for the pair.