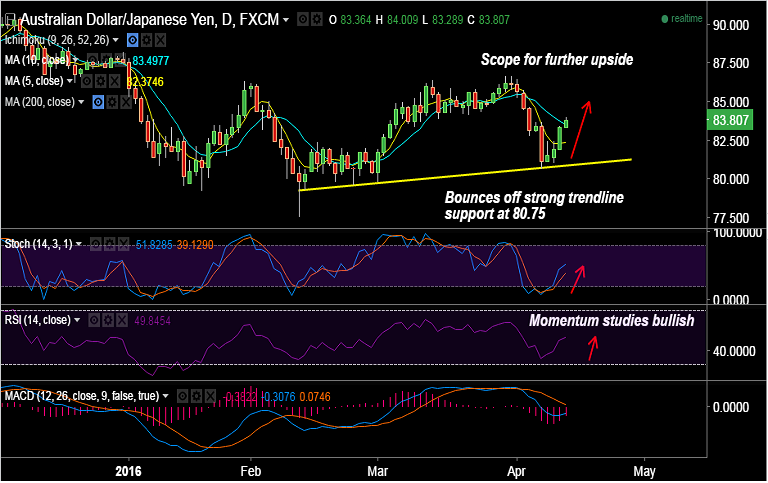

- Our previous call (http://www.econotimes.com/FxWirePro-AUD-JPY-bounces-off-strong-trendline-support-at-8075-good-to-buy-dips-192968) has hit all targets.

- The pair extended its winning streak into a fourth day today as the bulls were bolstered by improved risk appetite post strong China’s exports and imports data.

- Weakness in the Japanese currency against its American counterpart also contributes to the upside in the cross.

- Technicals on daily charts are supportive for further upside in the pair. Momentum studies are still bullish.

- The pair has broken above 10-DMA resistance at 83.50, which is now strong support on the downside ahead of 83.29 (session lows).

- Upside finds resistance at 84 and then 84.12 (Jan 7th highs) and further above at 84.22 (Jan 27th highs).

Recommendation: Book partial profits, raise stops to 83.50, target 84.20/30