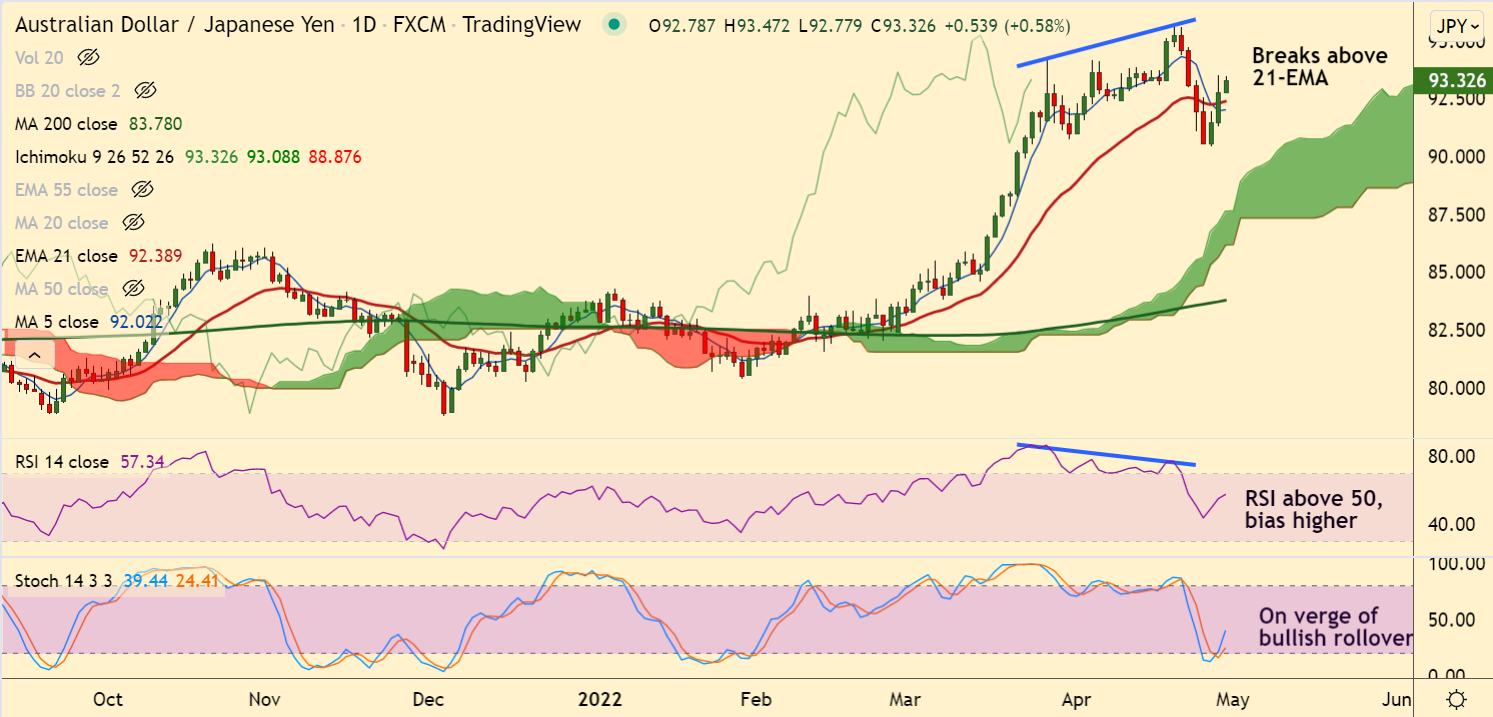

Chart - Courtesy Trading View

AUD/JPY was trading 0.59% higher on the day at 93.33 at around 10:15 GMT.

The pair is extending gains for the third consecutive session and has edged above 21-EMA.

Downside triggered by 'Bearish RSI Divergence' has paused at Lower Bollinger band and the pair has bounced higher.

GMMA indicator shows major trend is bullish, while minor trend is turning bullish.

The Japanese yen battered on Thursday after an extremely dovish BoJ, boosting upside in the pair.

The Bank of Japan (BOJ) on Thursday showed readiness for unlimited bond-buying to maintain the yield target.

The central bank cited sustained inflation below the 2.0% target and its economic forecasts lacked optimism, further weighing on the pair.

Support levels - 92.38 (21-EMA), 92.01 (5-DMA)

Resistance levels - 93.12 (20-DMA), 95.24 (Upper BB)

Summary: AUD/JPY on track for upside resumption. Scope for test of monthly highs at 95.74. Bullish invalidation only below 21-EMA.