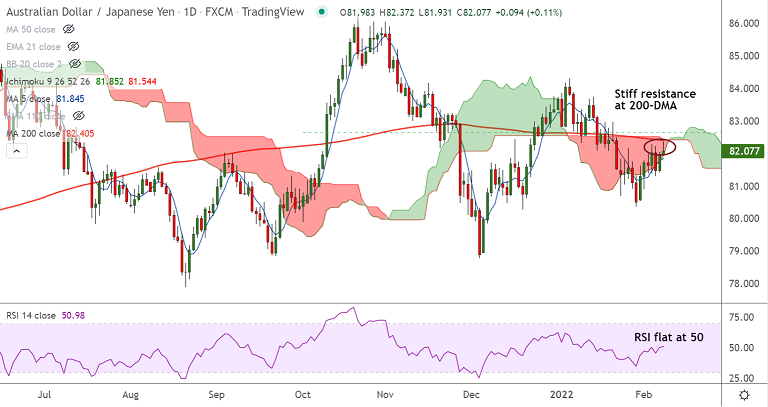

Chart - Courtesy Trading View

Technical Analysis: Bias Neutral

- AUD/JPY was trading 0.16% higher on the day at 82.11 at around 11:50 GMT

- The pair finds stiff resistance at 200-DMA any further upside only on break above

- GMMA indicator shows major and minor trend are neutral on the daily charts

- Price action holds above 200H MA, break above 200-DMA will fuel further gains

Support levels - 81.91 (21-EMA), 81.85 (5-DMA), 81.52 (200H MA)

Resistance levels - 82.40 (200-DMA), 82.65 (50% Fib), 83

Summary: AUD/JPY struggles at 200-DMA resistance. Technical indicators do not provide a clear directional bias. Break above 200-DMA will change near-term dynamics.